Attention: Please take a moment to consider our terms and conditions before posting.

Savings and Investments thread

Comments

-

When I brought it up on here the other day I got my head bitten off. But I agree.Weegie Addick said:I do wonder whether the cost of public sector pensions should be more considered in this debate? And that we should be provided with more accurate figures on the future liability. Seems there is a rather large black hole that no-one wants to admit to.1 -

If VAT was applied to financial services products then I think that would be my cue to retirecantersaddick said:

Fees on investment products, product fees, management fees, bank account fees (almost exclusively used by the wealthy) etc. Etc. Lots of things in this speace. Particularly when you get to hedge funds levels.valleynick66 said:

Not sure what products this envisages?cantersaddick said:I'm not mixing two different things. I'm pointing out that in one area of financial services (insurance) we apply a VAT equivalent tax that was introduced to purely because it was felt there was a gap there and it should be taxed at the equivalent rate. I (well the report by Professor Richard Murphy and of Tax Research UK) are pointing put that the same could be done to ALL financial services. I.e. apply a VAT equivalent tax or just merge into tax. That way the financial services that are only bought by the top 10% are taxed.

I can however see an argument for a higher level

of VAT on expensive / luxury items where the super rich can easily stomach it and the rest of us are not impacted. The counter would be it wouldn’t raise very much in absolute terms.

The report linked above has it at £8.7bn. I haven't gone into the detail of that calculation. But they are usually very thorough and I imagine it's a 20% applied to a 2024 total.1 -

Agree 100%. Private sector DB pensions are funded on the basis of actuarial valuations assessing a schemes ability to future liabilities with the requirement for funding top ups if they fall below a prescribed funding level. I was a company nominated trustee of my employer’s UK pension plan with 24,000 members for 20 odd years. Pension regulations and requirements for ongoing funding have increased over the years and, of course, the funds are ring-fenced from the employer’s assets to avoid a repeat of the Maxwell theft which led to the 1995 pensions act.golfaddick said:

When I brought it up on here the other day I got my head bitten off. But I agree.Weegie Addick said:I do wonder whether the cost of public sector pensions should be more considered in this debate? And that we should be provided with more accurate figures on the future liability. Seems there is a rather large black hole that no-one wants to admit to.0 -

I believe outside of the LGPS the remainder are different, i.e. they are not like a 'normal' company DB Pensions which as you say has to be funded, there is no fund, this years liabilities are simply paid by this years taxation and collections. I wonder if people realise the monies they pay in aren't actually sitting there waiting for them!robinofottershaw said:

Agree 100%. Private sector DB pensions are funded on the basis of actuarial valuations assessing a schemes ability to future liabilities with the requirement for funding top ups if they fall below a prescribed funding level. I was a company nominated trustee of my employer’s UK pension plan with 24,000 members for 20 odd years. Pension regulations and requirements for ongoing funding have increased over the years and, of course, the funds are ring-fenced from the employer’s assets to avoid a repeat of the Maxwell theft which led to the 1995 pensions act.golfaddick said:

When I brought it up on here the other day I got my head bitten off. But I agree.Weegie Addick said:I do wonder whether the cost of public sector pensions should be more considered in this debate? And that we should be provided with more accurate figures on the future liability. Seems there is a rather large black hole that no-one wants to admit to.1 -

You raised it in the context of resident (junior) doctors. You didn't get your head bitten off. People provided a counter point that changing this (for the worse) just as global demand for doctors is about to explode is maybe not a sensible idea if we still want a functioning health service.golfaddick said:

When I brought it up on here the other day I got my head bitten off. But I agree.Weegie Addick said:I do wonder whether the cost of public sector pensions should be more considered in this debate? And that we should be provided with more accurate figures on the future liability. Seems there is a rather large black hole that no-one wants to admit to.2 -

From 1st December the FSCS protection limit increases to £120k, up from £85k.

the temporary limit also increases to £1.4m7 -

Would disincentivise those the government want to ‘invest’ surely.golfaddick said:

If VAT was applied to financial services products then I think that would be my cue to retirecantersaddick said:

Fees on investment products, product fees, management fees, bank account fees (almost exclusively used by the wealthy) etc. Etc. Lots of things in this speace. Particularly when you get to hedge funds levels.valleynick66 said:

Not sure what products this envisages?cantersaddick said:I'm not mixing two different things. I'm pointing out that in one area of financial services (insurance) we apply a VAT equivalent tax that was introduced to purely because it was felt there was a gap there and it should be taxed at the equivalent rate. I (well the report by Professor Richard Murphy and of Tax Research UK) are pointing put that the same could be done to ALL financial services. I.e. apply a VAT equivalent tax or just merge into tax. That way the financial services that are only bought by the top 10% are taxed.

I can however see an argument for a higher level

of VAT on expensive / luxury items where the super rich can easily stomach it and the rest of us are not impacted. The counter would be it wouldn’t raise very much in absolute terms.

The report linked above has it at £8.7bn. I haven't gone into the detail of that calculation. But they are usually very thorough and I imagine it's a 20% applied to a 2024 total.Sounds more of a gimmick by saying only the top 10% use them - if the 10% includes those that still need to budget it’s meaningless. I suspect the top 10% is skewed by the super rich included.1 -

Would you really not invest because the fees have 20% VAT on them? I think you'd be shooting yourself in the foot by missing out on growth.valleynick66 said:

Would disincentivise those the government want to ‘invest’ surely.golfaddick said:

If VAT was applied to financial services products then I think that would be my cue to retirecantersaddick said:

Fees on investment products, product fees, management fees, bank account fees (almost exclusively used by the wealthy) etc. Etc. Lots of things in this speace. Particularly when you get to hedge funds levels.valleynick66 said:

Not sure what products this envisages?cantersaddick said:I'm not mixing two different things. I'm pointing out that in one area of financial services (insurance) we apply a VAT equivalent tax that was introduced to purely because it was felt there was a gap there and it should be taxed at the equivalent rate. I (well the report by Professor Richard Murphy and of Tax Research UK) are pointing put that the same could be done to ALL financial services. I.e. apply a VAT equivalent tax or just merge into tax. That way the financial services that are only bought by the top 10% are taxed.

I can however see an argument for a higher level

of VAT on expensive / luxury items where the super rich can easily stomach it and the rest of us are not impacted. The counter would be it wouldn’t raise very much in absolute terms.

The report linked above has it at £8.7bn. I haven't gone into the detail of that calculation. But they are usually very thorough and I imagine it's a 20% applied to a 2024 total.Sounds more of a gimmick by saying only the top 10% use them - if the 10% includes those that still need to budget it’s meaningless. I suspect the top 10% is skewed by the super rich included.

Not a gimmick to say that. The report I linked to a few pages ago showed that only the top 10% of people have anything invested above the basic workplace pension.0 -

.0

-

My point was it’s perception that can actually put off those that arent investing even a little.cantersaddick said:

Would you really not invest because the fees have 20% VAT on them? I think you'd be shooting yourself in the foot by missing out on growth.valleynick66 said:

Would disincentivise those the government want to ‘invest’ surely.golfaddick said:

If VAT was applied to financial services products then I think that would be my cue to retirecantersaddick said:

Fees on investment products, product fees, management fees, bank account fees (almost exclusively used by the wealthy) etc. Etc. Lots of things in this speace. Particularly when you get to hedge funds levels.valleynick66 said:

Not sure what products this envisages?cantersaddick said:I'm not mixing two different things. I'm pointing out that in one area of financial services (insurance) we apply a VAT equivalent tax that was introduced to purely because it was felt there was a gap there and it should be taxed at the equivalent rate. I (well the report by Professor Richard Murphy and of Tax Research UK) are pointing put that the same could be done to ALL financial services. I.e. apply a VAT equivalent tax or just merge into tax. That way the financial services that are only bought by the top 10% are taxed.

I can however see an argument for a higher level

of VAT on expensive / luxury items where the super rich can easily stomach it and the rest of us are not impacted. The counter would be it wouldn’t raise very much in absolute terms.

The report linked above has it at £8.7bn. I haven't gone into the detail of that calculation. But they are usually very thorough and I imagine it's a 20% applied to a 2024 total.Sounds more of a gimmick by saying only the top 10% use them - if the 10% includes those that still need to budget it’s meaningless. I suspect the top 10% is skewed by the super rich included.

Not a gimmick to say that. The report I linked to a few pages ago showed that only the top 10% of people have anything invested above the basic workplace pension.The earlier posts about media presenting bad news in this space comes to

mind.Of course for some it would be relative small sums but if you are investing a little only and the market also dips some will be scared off.The target group has to be those that can afford to pay more without it affecting their choices.It’s the risk I’m highlighting of adverse impact.2 -

Sponsored links:

-

Back to the here & now........

Stockmarkets around the world are falling for the 3rd day in a row. UK & Europe are down c1.5% today and Japan fell 3% overnight. Our FTSE comp has just brought everyone back into the mix again.0 -

A lot of what you post is usually well thought out and thought provoking: not that I agree with a lot of it. However this contains some rubbish. Putting aside the highly emotive phrase "squeezing everyone below them".cantersaddick said:

It is just maths but what thats missing is that this has happened in a period where the UK economy has barely grown, wages have stagnated and living standards have fallen. So where has this additional wealth for those at the top come from? Squeezing everyone below themRob7Lee said:

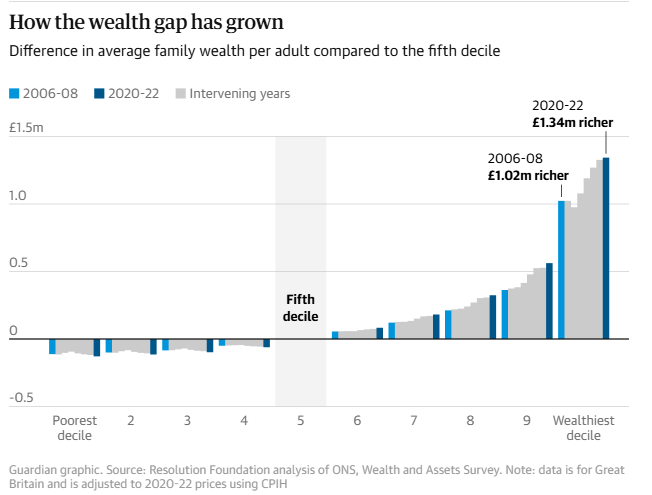

In it's simplest form isn't that chart a simple math/economics when asset prices increase? (it seems to be based on wealth and asset).cantersaddick said:This chart is brilliant. Made by the guardian but from a Resolution foundation report. shows how for the bottom 50% there is almost no change since 06-08 but for the top 10% there has been massive growth. As that's not even the full picture as within that top 10% the growth has been massively concentrated for the top 1%.

https://www.theguardian.com/inequality/2025/oct/08/lifetime-of-earnings-not-enough-for-uk-workers-to-join-wealthiest-10-report-says

By virtue of the fact someone is in the top x% means they hold more asset. If asset prices increase then of course the gap will widen. If asset prices dropped, i.e. a housing market crash, stock market and/or gold prices plummet, the chart would look very different.

It's like saying I have £10,000 in the bank @ 5% APR earning or increasing my assets by £500, yet someone who has £1,000 in the bank only increase by £50 with the same 5% APR, therefore the gap widens - of course it will.

Unless we lived in a communist state where everyone owns the same and earns the same, the chart is always going to head that way in a time of asset appreciation.

If all assets dropped 50% would it be OK for the top percentiles to complain they've reduced more than the lower percentiles and that's really unfair? Or is that basic math?

What that points to is one of the issues I've been talking about - conventional/traditional economic theory just not holding anymore in the modern world. In this case the idea that Growth is the driver of increases in wealth and living standards. What we now have is an economy where those at the top win either way, growth or no growth through corporate power suppressing wages despite record profits, lower tax exposure so services get underfunded and the ability to hoover up assets at a discount in a downturn so as to monopolise the benefits of any growth that does come right at the very top.

The biggest factor in why the wealthier have become wealthier is almost certain to be overseas investment. Any portfolio will be heavily weighted overseas, particularly the US. Anyone with wealth will follow that pattern. Don't mix wealth and earnings (tongue in cheek joke!).

One of the biggest problems is the UK's very poor record in productivity growth. And I suspect any benefit from that is more than eaten up by increased welfare and pension spend squeezing the working population.2 -

We just need the man from across the pond to do something and everyone will be back in play!! Or maybe even Rachel from accounts will assist us next week.golfaddick said:Back to the here & now........

Stockmarkets around the world are falling for the 3rd day in a row. UK & Europe are down c1.5% today and Japan fell 3% overnight. Our FTSE comp has just brought everyone back into the mix again.

Starting to feel quite pleased that I cashed a load in, anyone have any thoughts on Gold, hold or sell..... answers on a postcard.......

0 -

I'm off to an Investment presentation from Invesco tomorrow so I'll see what they say about Gold. Part of their spiel is going to be about alternative investments......inc Crypto !Rob7Lee said:

We just need the man from across the pond to do something and everyone will be back in play!! Or maybe even Rachel from accounts will assist us next week.golfaddick said:Back to the here & now........

Stockmarkets around the world are falling for the 3rd day in a row. UK & Europe are down c1.5% today and Japan fell 3% overnight. Our FTSE comp has just brought everyone back into the mix again.

Starting to feel quite pleased that I cashed a load in, anyone have any thoughts on Gold, hold or sell..... answers on a postcard.......1 -

Not going to lie, I thought I was out of the contest.Rob7Lee said:FTSE100 Level 9,899.60 Name Level Variance % Variance Thread Killer 9761 138.6 1.40% Jints 9750 149.6 1.51% Friend or Defoe 9657 242.6 2.45% Arsenetatters 9525 374.6 3.78% @TelMc32 9450 449.6 4.54% IdleHans 9434 465.6 4.70% Addick Addict 9424 475.6 4.80% Diebythesword 9400 499.6 5.05% cafcpolo 9395 504.6 5.10% StrikerFirmani 9365 534.6 5.40% WHAddick 9335 564.6 5.70% meldrew66 9301 598.6 6.05% Hornchurch 9275 624.6 6.31% Housty 9254 645.6 6.52% blackpool72 9245 654.6 6.61% TheGhostofTomHovi 9236 663.6 6.70% CharltonKerry 9234 665.6 6.72% Covered End 9220 679.6 6.86% Carter 9212 687.6 6.95% Jamescafc 9200 699.6 7.07% Addickinedi 9176 723.6 7.31% RalphMilne 9168 731.6 7.39% valleynick66 9165 734.6 7.42% guinnessaddick 9152 747.6 7.55% thecat 9136 763.6 7.71% fat man on a moped 9116 783.6 7.92% wwaddick 9104 795.6 8.04% golfaddick 9101 798.6 8.07% WishIdStayedInThe Pub 9101 798.6 8.07% Jon_CAFC_ 9088 811.6 8.20% BalladMan 9058 841.6 8.50% Huskaris 9025 874.6 8.83% Solidgone 9021 878.6 8.88% Rob7Lee 9000 899.6 9.09% Bangkokaddick 8998 901.6 9.11% Pedro45 8925 974.6 9.84% LargeAddick 8884 1015.6 10.26% Redman 8876 1023.6 10.34% holyjo 8810 1089.6 11.01% PragueAddick 8725 1174.6 11.87% CAFCWest 8621 1278.6 12.92% Fortune 82nd Minute 8571 1328.6 13.42% HardyAddick 8548 1351.6 13.65% bobmunro 8452 1447.6 14.62% Lenglover 8301 1598.6 16.15% Siv_In_Norfolk 7400 2499.6 25.25% Er_Be_Ab_Pl_Wo_Wo_Ch 6500 3399.6 34.34%

But like a good Nathan Jones team, with markets in free fall I'm ready to strike at the last moment.

And with the bomb squad of Rachel from accounts and the Donald ready and waiting in the wings to come on and do more damage, now feeling pretty confident that I'm in with a good shout of the title. Sadly.1 -

The next few days ste going to be painful on stock prices - @cantersaddick might be time to get the wealth chart redrawn!! 😉Fortune 82nd Minute said:

Not going to lie, I thought I was out of the contest.Rob7Lee said:FTSE100 Level 9,899.60 Name Level Variance % Variance Thread Killer 9761 138.6 1.40% Jints 9750 149.6 1.51% Friend or Defoe 9657 242.6 2.45% Arsenetatters 9525 374.6 3.78% @TelMc32 9450 449.6 4.54% IdleHans 9434 465.6 4.70% Addick Addict 9424 475.6 4.80% Diebythesword 9400 499.6 5.05% cafcpolo 9395 504.6 5.10% StrikerFirmani 9365 534.6 5.40% WHAddick 9335 564.6 5.70% meldrew66 9301 598.6 6.05% Hornchurch 9275 624.6 6.31% Housty 9254 645.6 6.52% blackpool72 9245 654.6 6.61% TheGhostofTomHovi 9236 663.6 6.70% CharltonKerry 9234 665.6 6.72% Covered End 9220 679.6 6.86% Carter 9212 687.6 6.95% Jamescafc 9200 699.6 7.07% Addickinedi 9176 723.6 7.31% RalphMilne 9168 731.6 7.39% valleynick66 9165 734.6 7.42% guinnessaddick 9152 747.6 7.55% thecat 9136 763.6 7.71% fat man on a moped 9116 783.6 7.92% wwaddick 9104 795.6 8.04% golfaddick 9101 798.6 8.07% WishIdStayedInThe Pub 9101 798.6 8.07% Jon_CAFC_ 9088 811.6 8.20% BalladMan 9058 841.6 8.50% Huskaris 9025 874.6 8.83% Solidgone 9021 878.6 8.88% Rob7Lee 9000 899.6 9.09% Bangkokaddick 8998 901.6 9.11% Pedro45 8925 974.6 9.84% LargeAddick 8884 1015.6 10.26% Redman 8876 1023.6 10.34% holyjo 8810 1089.6 11.01% PragueAddick 8725 1174.6 11.87% CAFCWest 8621 1278.6 12.92% Fortune 82nd Minute 8571 1328.6 13.42% HardyAddick 8548 1351.6 13.65% bobmunro 8452 1447.6 14.62% Lenglover 8301 1598.6 16.15% Siv_In_Norfolk 7400 2499.6 25.25% Er_Be_Ab_Pl_Wo_Wo_Ch 6500 3399.6 34.34%

But like a good Nathan Jones team, with markets in free fall I'm ready to strike at the last moment.

And with the bomb squad of Rachel from accounts and the Donald ready and waiting in the wings to come on and do more damage, now feeling pretty confident that I'm in with a good shout of the title. Sadly.2 -

Fortune 82nd Minute said:

Not going to lie, I thought I was out of the contest.Rob7Lee said:FTSE100 Level 9,899.60 Name Level Variance % Variance Thread Killer 9761 138.6 1.40% Jints 9750 149.6 1.51% Friend or Defoe 9657 242.6 2.45% Arsenetatters 9525 374.6 3.78% @TelMc32 9450 449.6 4.54% IdleHans 9434 465.6 4.70% Addick Addict 9424 475.6 4.80% Diebythesword 9400 499.6 5.05% cafcpolo 9395 504.6 5.10% StrikerFirmani 9365 534.6 5.40% WHAddick 9335 564.6 5.70% meldrew66 9301 598.6 6.05% Hornchurch 9275 624.6 6.31% Housty 9254 645.6 6.52% blackpool72 9245 654.6 6.61% TheGhostofTomHovi 9236 663.6 6.70% CharltonKerry 9234 665.6 6.72% Covered End 9220 679.6 6.86% Carter 9212 687.6 6.95% Jamescafc 9200 699.6 7.07% Addickinedi 9176 723.6 7.31% RalphMilne 9168 731.6 7.39% valleynick66 9165 734.6 7.42% guinnessaddick 9152 747.6 7.55% thecat 9136 763.6 7.71% fat man on a moped 9116 783.6 7.92% wwaddick 9104 795.6 8.04% golfaddick 9101 798.6 8.07% WishIdStayedInThe Pub 9101 798.6 8.07% Jon_CAFC_ 9088 811.6 8.20% BalladMan 9058 841.6 8.50% Huskaris 9025 874.6 8.83% Solidgone 9021 878.6 8.88% Rob7Lee 9000 899.6 9.09% Bangkokaddick 8998 901.6 9.11% Pedro45 8925 974.6 9.84% LargeAddick 8884 1015.6 10.26% Redman 8876 1023.6 10.34% holyjo 8810 1089.6 11.01% PragueAddick 8725 1174.6 11.87% CAFCWest 8621 1278.6 12.92% Fortune 82nd Minute 8571 1328.6 13.42% HardyAddick 8548 1351.6 13.65% bobmunro 8452 1447.6 14.62% Lenglover 8301 1598.6 16.15% Siv_In_Norfolk 7400 2499.6 25.25% Er_Be_Ab_Pl_Wo_Wo_Ch 6500 3399.6 34.34%

But like a good Nathan Jones team, with markets in free fall I'm ready to strike at the last moment.

And with the bomb squad of Rachel from accounts and the Donald ready and waiting in the wings to come on and do more damage, now feeling pretty confident that I'm in with a good shout of the title. Sadly.

The Donald was ranting more incoherently than usual yesterday - anything is possible.0 -

Rob7Lee said:

The next few days ste going to be painful on stock prices - @cantersaddick might be time to get the wealth chart redrawn!! 😉Fortune 82nd Minute said:

Not going to lie, I thought I was out of the contest.Rob7Lee said:FTSE100 Level 9,899.60 Name Level Variance % Variance Thread Killer 9761 138.6 1.40% Jints 9750 149.6 1.51% Friend or Defoe 9657 242.6 2.45% Arsenetatters 9525 374.6 3.78% @TelMc32 9450 449.6 4.54% IdleHans 9434 465.6 4.70% Addick Addict 9424 475.6 4.80% Diebythesword 9400 499.6 5.05% cafcpolo 9395 504.6 5.10% StrikerFirmani 9365 534.6 5.40% WHAddick 9335 564.6 5.70% meldrew66 9301 598.6 6.05% Hornchurch 9275 624.6 6.31% Housty 9254 645.6 6.52% blackpool72 9245 654.6 6.61% TheGhostofTomHovi 9236 663.6 6.70% CharltonKerry 9234 665.6 6.72% Covered End 9220 679.6 6.86% Carter 9212 687.6 6.95% Jamescafc 9200 699.6 7.07% Addickinedi 9176 723.6 7.31% RalphMilne 9168 731.6 7.39% valleynick66 9165 734.6 7.42% guinnessaddick 9152 747.6 7.55% thecat 9136 763.6 7.71% fat man on a moped 9116 783.6 7.92% wwaddick 9104 795.6 8.04% golfaddick 9101 798.6 8.07% WishIdStayedInThe Pub 9101 798.6 8.07% Jon_CAFC_ 9088 811.6 8.20% BalladMan 9058 841.6 8.50% Huskaris 9025 874.6 8.83% Solidgone 9021 878.6 8.88% Rob7Lee 9000 899.6 9.09% Bangkokaddick 8998 901.6 9.11% Pedro45 8925 974.6 9.84% LargeAddick 8884 1015.6 10.26% Redman 8876 1023.6 10.34% holyjo 8810 1089.6 11.01% PragueAddick 8725 1174.6 11.87% CAFCWest 8621 1278.6 12.92% Fortune 82nd Minute 8571 1328.6 13.42% HardyAddick 8548 1351.6 13.65% bobmunro 8452 1447.6 14.62% Lenglover 8301 1598.6 16.15% Siv_In_Norfolk 7400 2499.6 25.25% Er_Be_Ab_Pl_Wo_Wo_Ch 6500 3399.6 34.34%

But like a good Nathan Jones team, with markets in free fall I'm ready to strike at the last moment.

And with the bomb squad of Rachel from accounts and the Donald ready and waiting in the wings to come on and do more damage, now feeling pretty confident that I'm in with a good shout of the title. Sadly.

I know that investing in the stock market should be looked at over a 5 year period minimum but it will be quite funny if the lady who worked in the complaints department at the Halifax does, as rumoured, next week reduce the amount you can put into a cash Isa and instead requires people to invest in a S&S ISA just at a time when the markets are in freefall!

You have to chuckle.0 -

Could be perfect timing…buy the lows! 😉Fortune 82nd Minute said:Rob7Lee said:r

The next few days ste going to be painful on stock prices - @cantersaddick might be time to get the wealth chart redrawn!! 😉Fortune 82nd Minute said:

Not going to lie, I thought I was out of the contest.Rob7Lee said:FTSE100 Level 9,899.60 Name Level Variance % Variance Thread Killer 9761 138.6 1.40% Jints 9750 149.6 1.51% Friend or Defoe 9657 242.6 2.45% Arsenetatters 9525 374.6 3.78% @TelMc32 9450 449.6 4.54% IdleHans 9434 465.6 4.70% Addick Addict 9424 475.6 4.80% Diebythesword 9400 499.6 5.05% cafcpolo 9395 504.6 5.10% StrikerFirmani 9365 534.6 5.40% WHAddick 9335 564.6 5.70% meldrew66 9301 598.6 6.05% Hornchurch 9275 624.6 6.31% Housty 9254 645.6 6.52% blackpool72 9245 654.6 6.61% TheGhostofTomHovi 9236 663.6 6.70% CharltonKerry 9234 665.6 6.72% Covered End 9220 679.6 6.86% Carter 9212 687.6 6.95% Jamescafc 9200 699.6 7.07% Addickinedi 9176 723.6 7.31% RalphMilne 9168 731.6 7.39% valleynick66 9165 734.6 7.42% guinnessaddick 9152 747.6 7.55% thecat 9136 763.6 7.71% fat man on a moped 9116 783.6 7.92% wwaddick 9104 795.6 8.04% golfaddick 9101 798.6 8.07% WishIdStayedInThe Pub 9101 798.6 8.07% Jon_CAFC_ 9088 811.6 8.20% BalladMan 9058 841.6 8.50% Huskaris 9025 874.6 8.83% Solidgone 9021 878.6 8.88% Rob7Lee 9000 899.6 9.09% Bangkokaddick 8998 901.6 9.11% Pedro45 8925 974.6 9.84% LargeAddick 8884 1015.6 10.26% Redman 8876 1023.6 10.34% holyjo 8810 1089.6 11.01% PragueAddick 8725 1174.6 11.87% CAFCWest 8621 1278.6 12.92% Fortune 82nd Minute 8571 1328.6 13.42% HardyAddick 8548 1351.6 13.65% bobmunro 8452 1447.6 14.62% Lenglover 8301 1598.6 16.15% Siv_In_Norfolk 7400 2499.6 25.25% Er_Be_Ab_Pl_Wo_Wo_Ch 6500 3399.6 34.34%

But like a good Nathan Jones team, with markets in free fall I'm ready to strike at the last moment.

And with the bomb squad of Rachel from accounts and the Donald ready and waiting in the wings to come on and do more damage, now feeling pretty confident that I'm in with a good shout of the title. Sadly.

I know that investing in the stock market should be looked at over a 5 year period minimum but it will be quite funny if the lady who worked in the complaints department at the Halifax does, as rumoured, next week reduce the amount you can put into a cash Isa and instead requires people to invest in a S&S ISA just at a time when the markets are in freefall!

You have to chuckle.3 -

Is everyone convinced the markets are going to collapse over the next couple of weeks? Is it possible that the measures might not be as extreme as feared and the market reacts well to it?!1

-

Sponsored links:

-

Wall St hustlers are shorting tech stocks and even the head of Google says there is irrationality in the market. If stocks fall on Thursday even if Nvidia's results are good then we will be on the slide for sure.paulsturgess said:Is everyone convinced the markets are going to collapse over the next couple of weeks? Is it possible that the measures might not be as extreme as feared and the market reacts well to it?!0 -

one of the things markets hate more than anything is uncertainty. Seems unlikely they will collapse anymore because of her budget unless she real pulls out something even more stupid than the many things already floated.paulsturgess said:Is everyone convinced the markets are going to collapse over the next couple of weeks? Is it possible that the measures might not be as extreme as feared and the market reacts well to it?!1 -

The UK stockmarket wont collapse directly because of the Budget.....but might collapse if the Bond markets dont take favourably to it.redman said:

one of the things markets hate more than anything is uncertainty. Seems unlikely they will collapse anymore because of her budget unless she real pulls out something even more stupid than the many things already floated.paulsturgess said:Is everyone convinced the markets are going to collapse over the next couple of weeks? Is it possible that the measures might not be as extreme as feared and the market reacts well to it?!0 -

One assumes the so called ‘pitch rolling’ (awful phrase) of recent days means that won’t happen.golfaddick said:

The UK stockmarket wont collapse directly because of the Budget.....but might collapse if the Bond markets dont take favourably to it.redman said:

one of the things markets hate more than anything is uncertainty. Seems unlikely they will collapse anymore because of her budget unless she real pulls out something even more stupid than the many things already floated.paulsturgess said:Is everyone convinced the markets are going to collapse over the next couple of weeks? Is it possible that the measures might not be as extreme as feared and the market reacts well to it?!0 -

Well this is why I haven’t bothered pulling anything out.redman said:

one of the things markets hate more than anything is uncertainty. Seems unlikely they will collapse anymore because of her budget unless she real pulls out something even more stupid than the many things already floated.paulsturgess said:Is everyone convinced the markets are going to collapse over the next couple of weeks? Is it possible that the measures might not be as extreme as feared and the market reacts well to it?!But then truss…0 -

Handy that the ONS has just found £20bn hidden down the back of sofa. Probably along with the 115,000 expats that they didnt know had left last year either.valleynick66 said:

One assumes the so called ‘pitch rolling’ (awful phrase) of recent days means that won’t happen.golfaddick said:

The UK stockmarket wont collapse directly because of the Budget.....but might collapse if the Bond markets dont take favourably to it.redman said:

one of the things markets hate more than anything is uncertainty. Seems unlikely they will collapse anymore because of her budget unless she real pulls out something even more stupid than the many things already floated.paulsturgess said:Is everyone convinced the markets are going to collapse over the next couple of weeks? Is it possible that the measures might not be as extreme as feared and the market reacts well to it?!5 -

Its all a myth by right wing think tanks who have infiltrated the ONS!golfaddick said:

Handy that the ONS has just found £20bn hidden down the back of sofa. Probably along with the 115,000 expats that they didnt know had left last year either.valleynick66 said:

One assumes the so called ‘pitch rolling’ (awful phrase) of recent days means that won’t happen.golfaddick said:

The UK stockmarket wont collapse directly because of the Budget.....but might collapse if the Bond markets dont take favourably to it.redman said:

one of the things markets hate more than anything is uncertainty. Seems unlikely they will collapse anymore because of her budget unless she real pulls out something even more stupid than the many things already floated.paulsturgess said:Is everyone convinced the markets are going to collapse over the next couple of weeks? Is it possible that the measures might not be as extreme as feared and the market reacts well to it?!1 -

And it won’t be the rich leaving, that’ll never happen 🧐Huskaris said:

It’s all a myth by right wing think tanks who have infiltrated the ONS!golfaddick said:

Handy that the ONS has just found £20bn hidden down the back of sofa. Probably along with the 115,000 expats that they didnt know had left last year either.valleynick66 said:

One assumes the so called ‘pitch rolling’ (awful phrase) of recent days means that won’t happen.golfaddick said:

The UK stockmarket wont collapse directly because of the Budget.....but might collapse if the Bond markets dont take favourably to it.redman said:

one of the things markets hate more than anything is uncertainty. Seems unlikely they will collapse anymore because of her budget unless she real pulls out something even more stupid than the many things already floated.paulsturgess said:Is everyone convinced the markets are going to collapse over the next couple of weeks? Is it possible that the measures might not be as extreme as feared and the market reacts well to it?!

on the markets I don’t see them free falling after the budget unless our accounts clerk does something more silly than expected. But we’ve ridden one hell of a wave, my gut feel (and that’s all it is) makes me think a correction to one degree is coming.0 -

Great bottom signal this thread. Markets bouncing today.3

-

I think there is still a bit to go before the markets bottom out. But they have all fallen between 3%-5% over the past 5 days so there is still a buying signal if you've taken profits earlier this month.Diebythesword said:Great bottom signal this thread. Markets bouncing today.0