Energy Bills

Comments

-

It’s a hugely complex market. But these notes on the article do add some perspective ie it’s not a simple cash giveaway :ME14addick said:

Thanks for posting, subsidising fossil fuels, when they make such huge profits is absolutely crazy.cantersaddick said:

The subsidies point is a rather frustrating misleading one though.ForestHillAddick said:Just to weigh in on this, the average UK energy bill is made up of 3 components:

1. Wholesale energy prices, for gas it's dependent on international markets mainly, for power is more dependent on gas price + domestic wind/solar production

2. Transportation and balancing costs, it takes money to maintain all the pilons and gas pipes without anything exploding

3. Subsidies, it also cost money to convince renewable developers to build their wind/solar sites in the UK, this money doesn't come from tax revenues, it gets added to end user bills instead

So just because wholesale prices drop, does not mean end user bills drop, in fact, by increasing renewable generation, you increase balancing and subsidy costs, so numbers 2 and 3 above will increase, whilst number 1 decreases.

The road to net 0 will not decrease bills in the next 20 years, it'll decrease bills after that in general, and hopefully environmental damage.

In my opinion, it's a price we have to pay now for future generations.

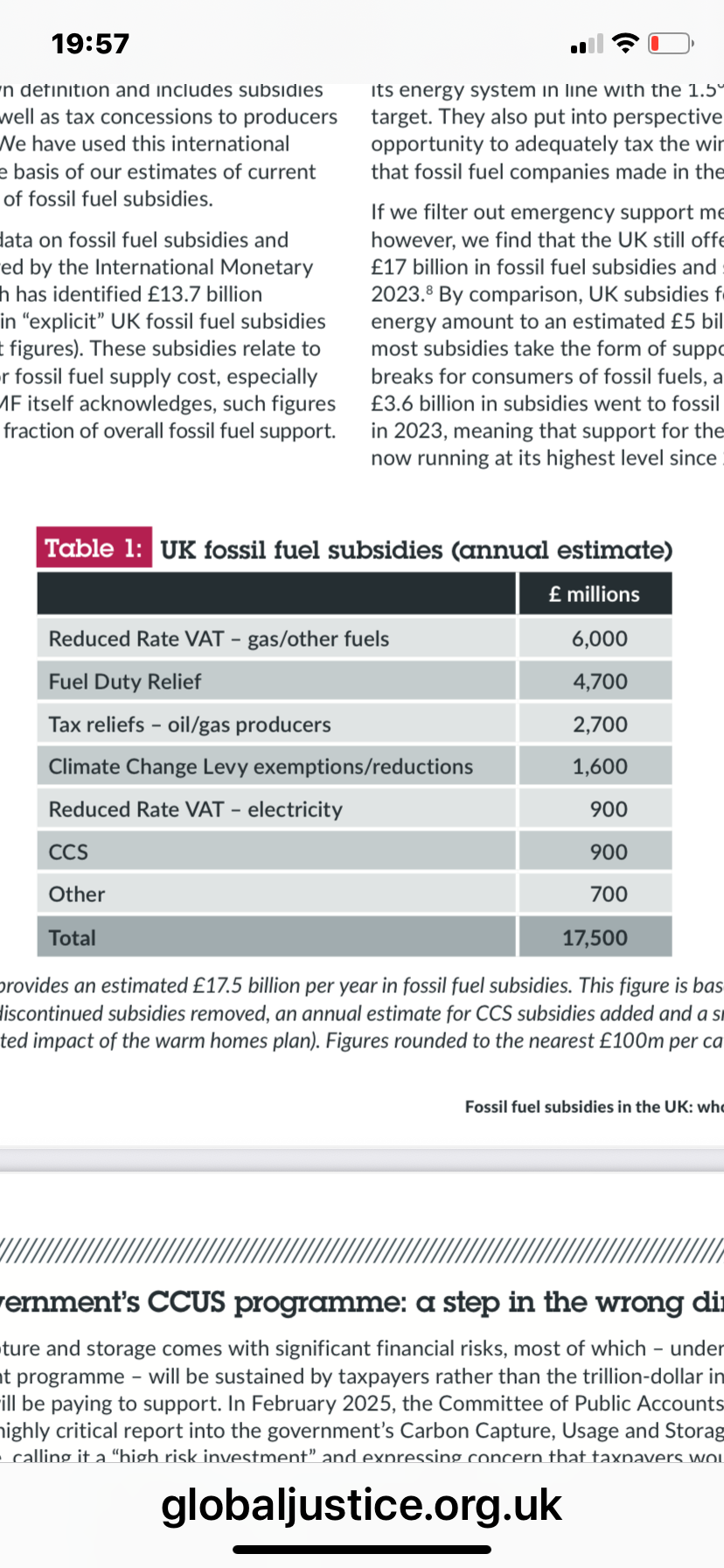

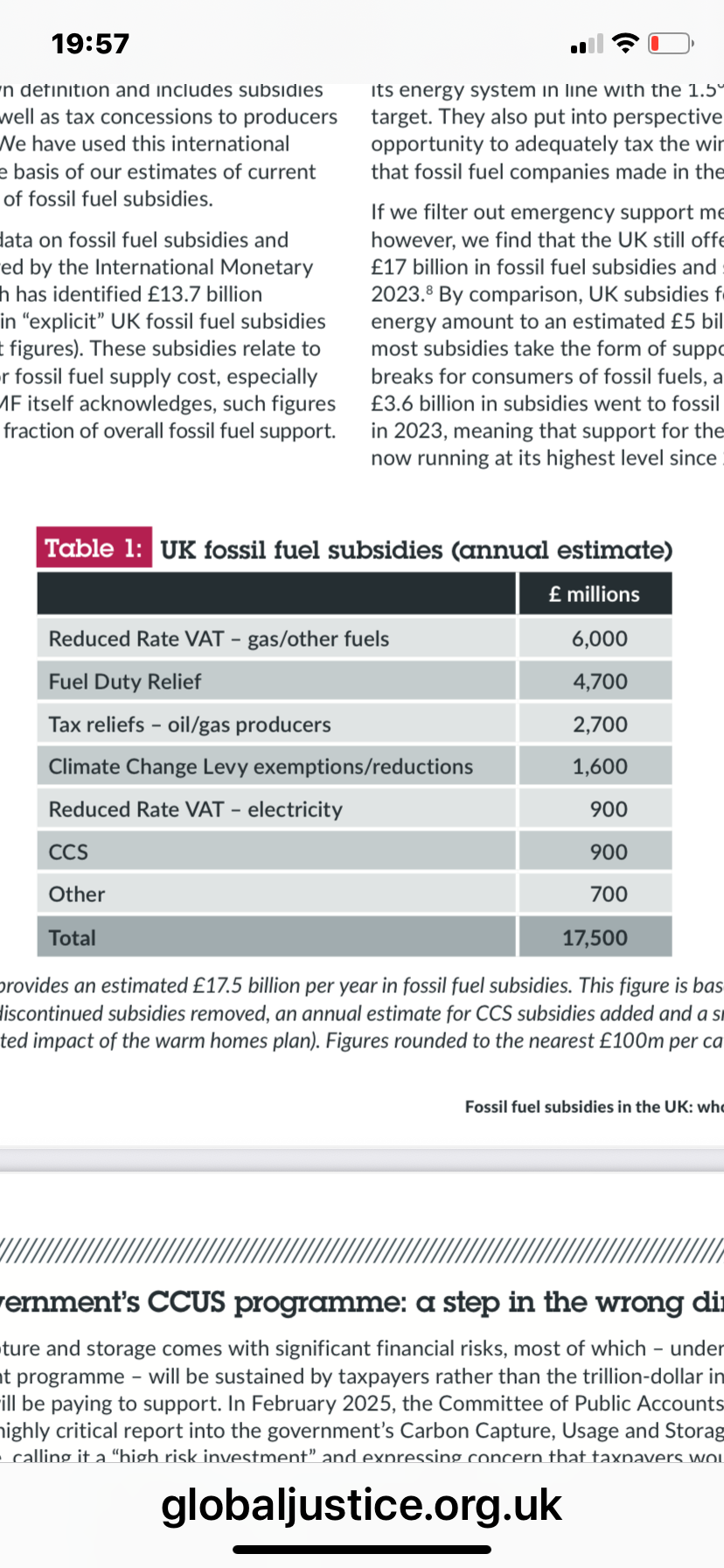

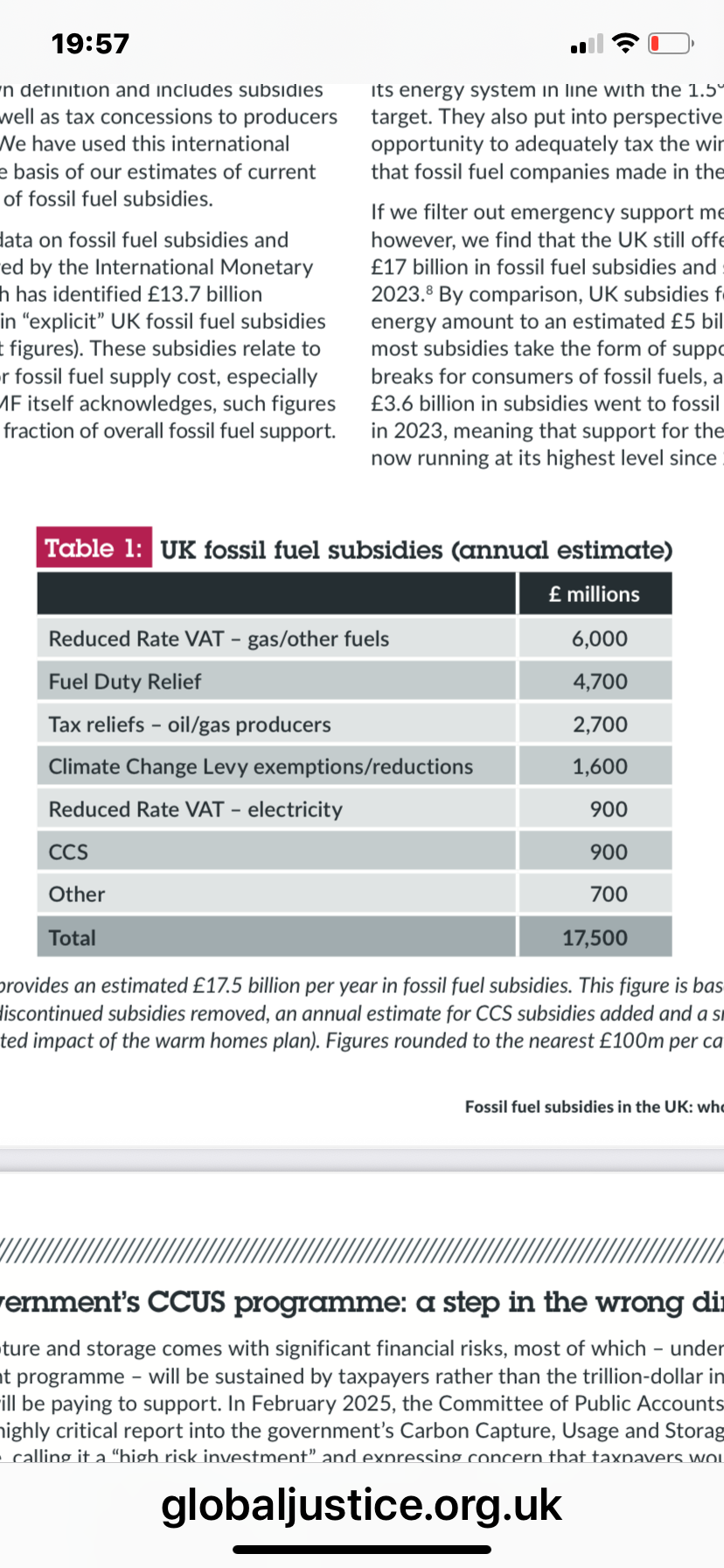

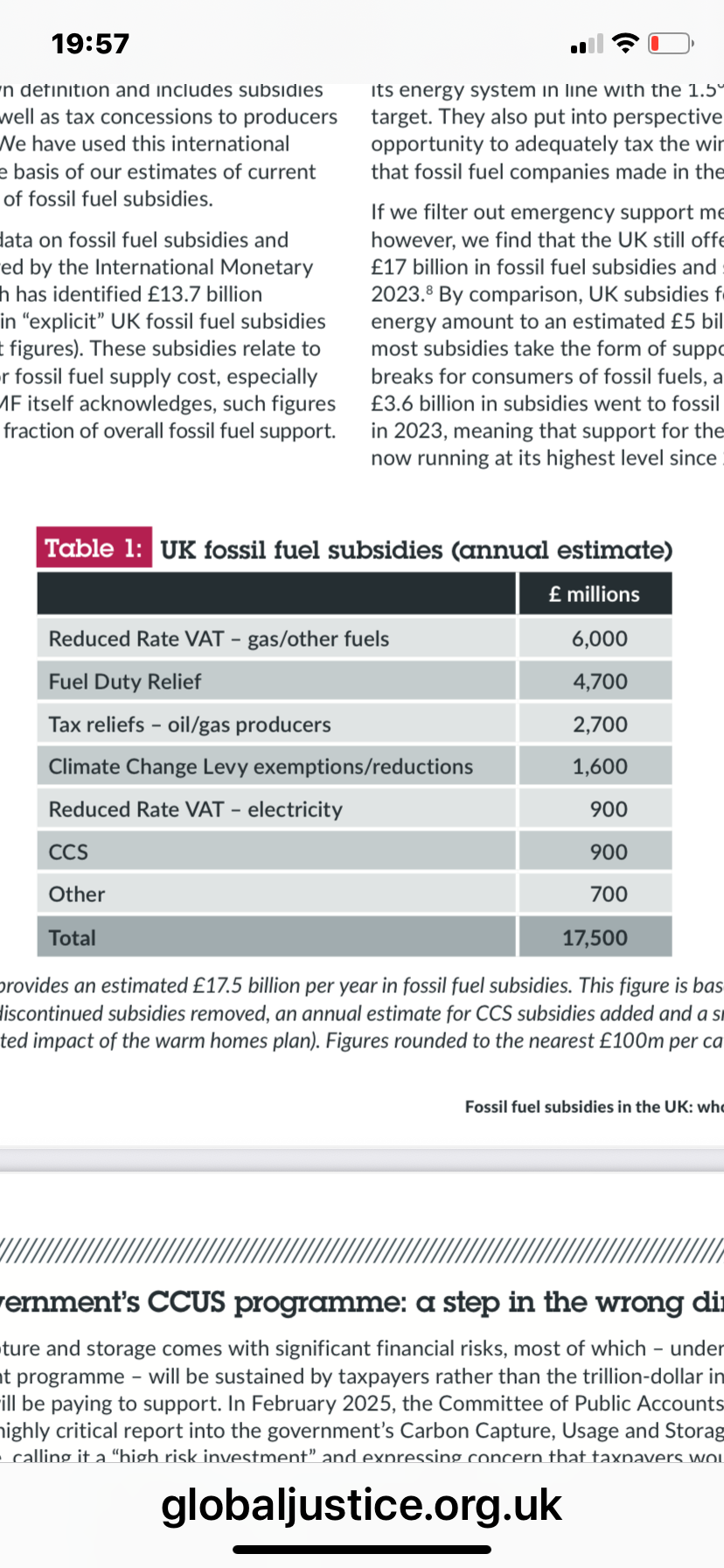

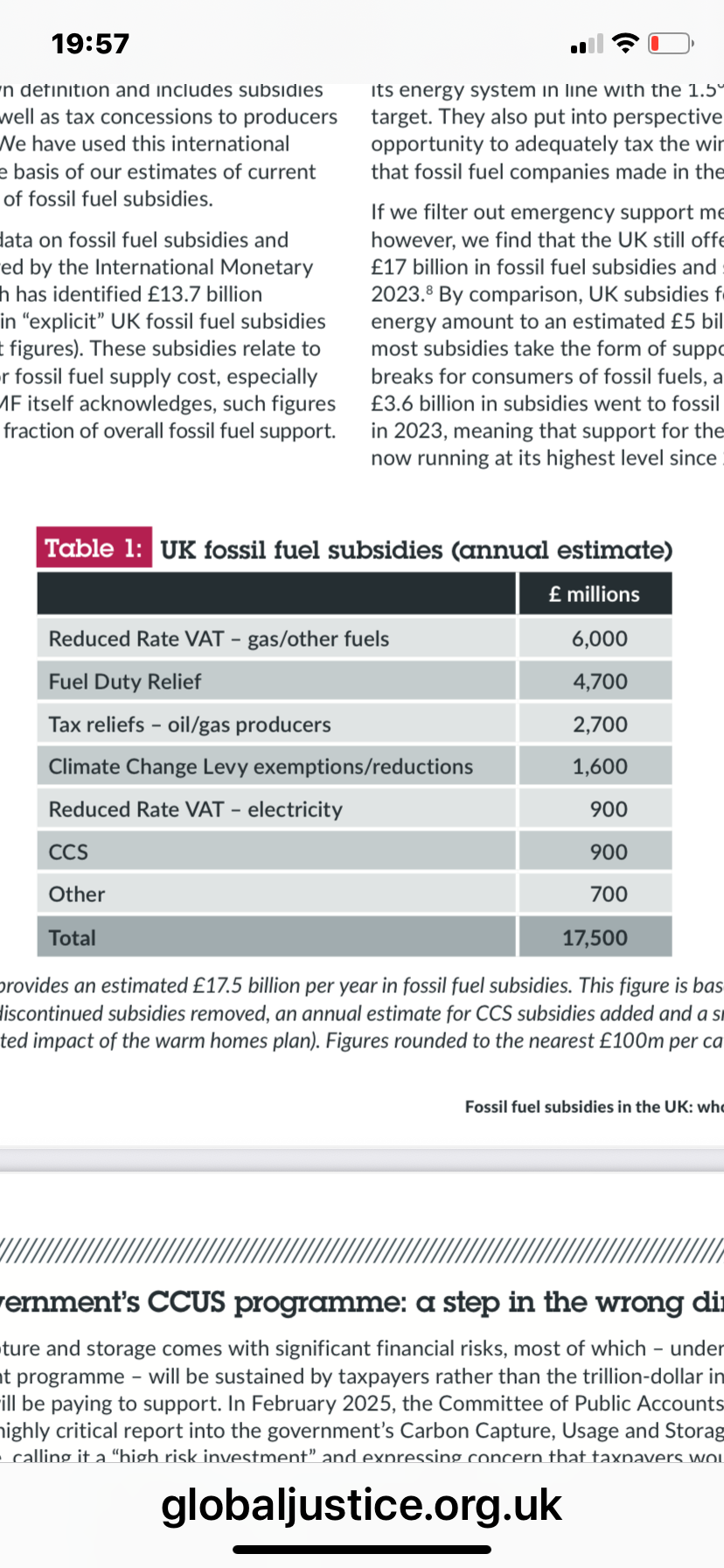

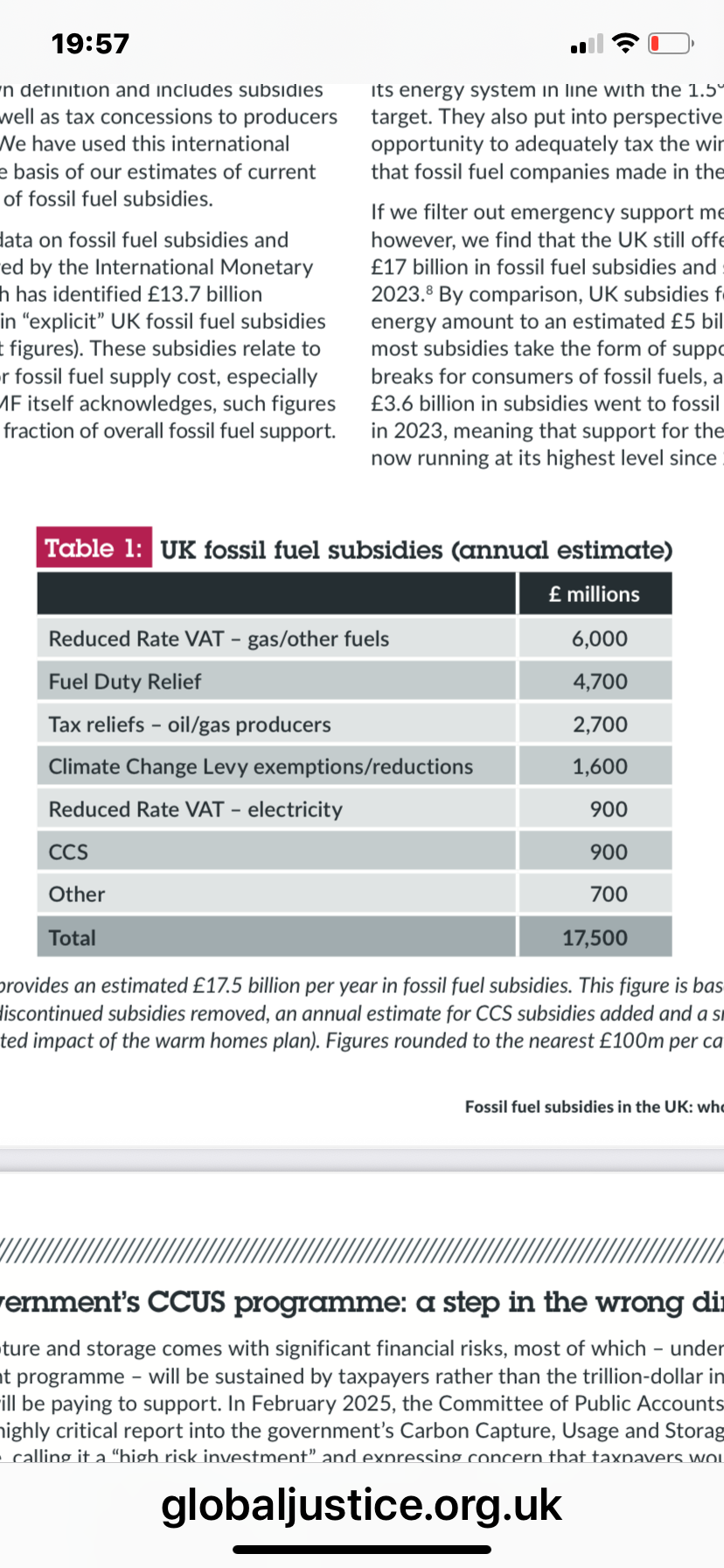

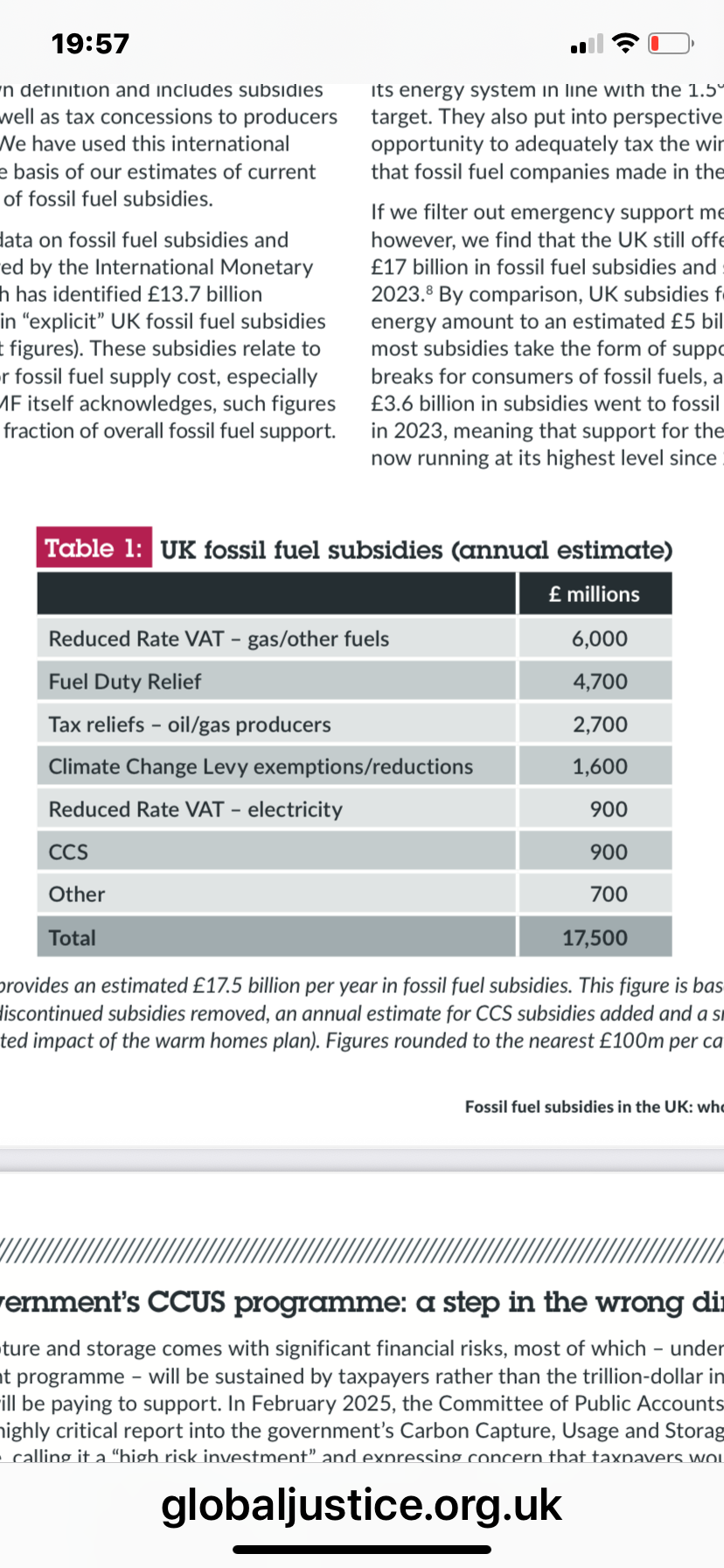

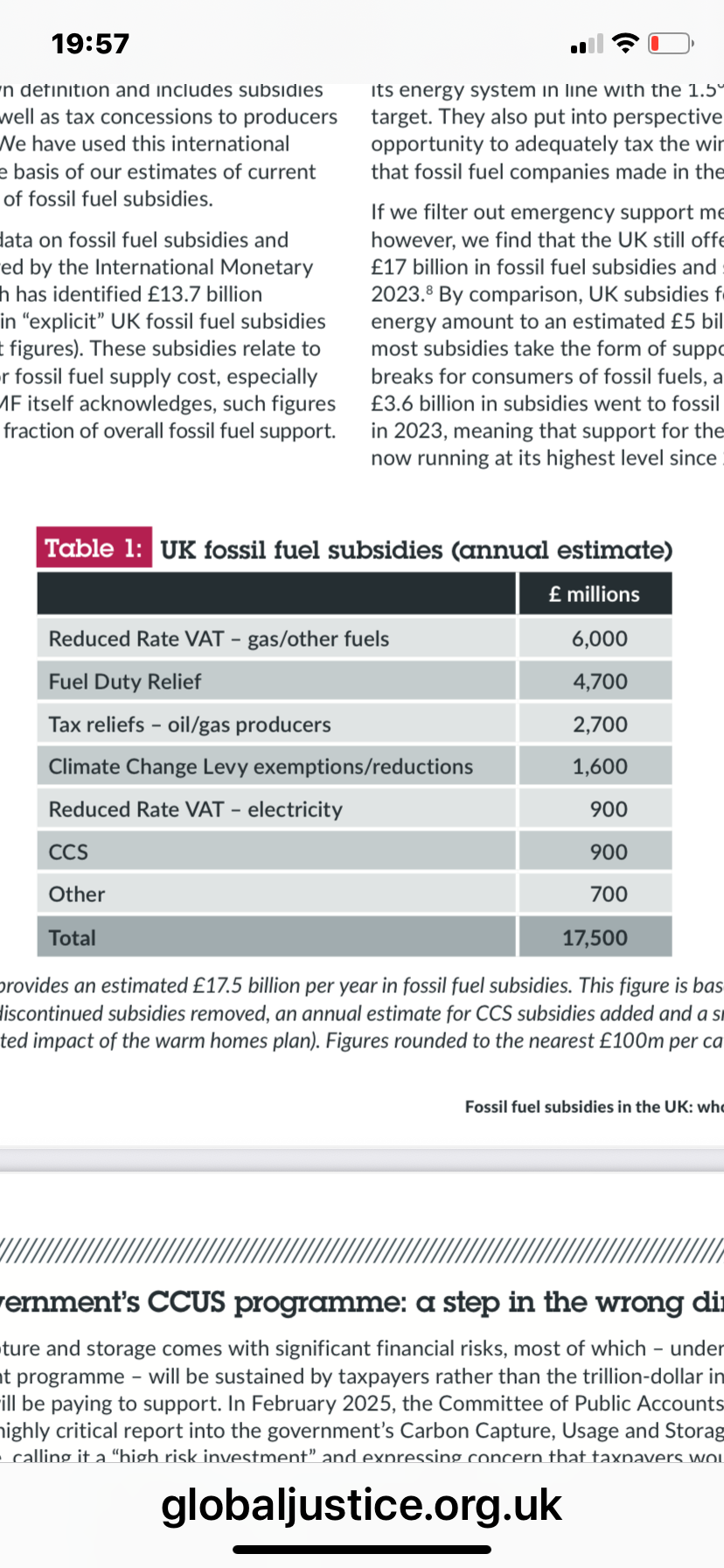

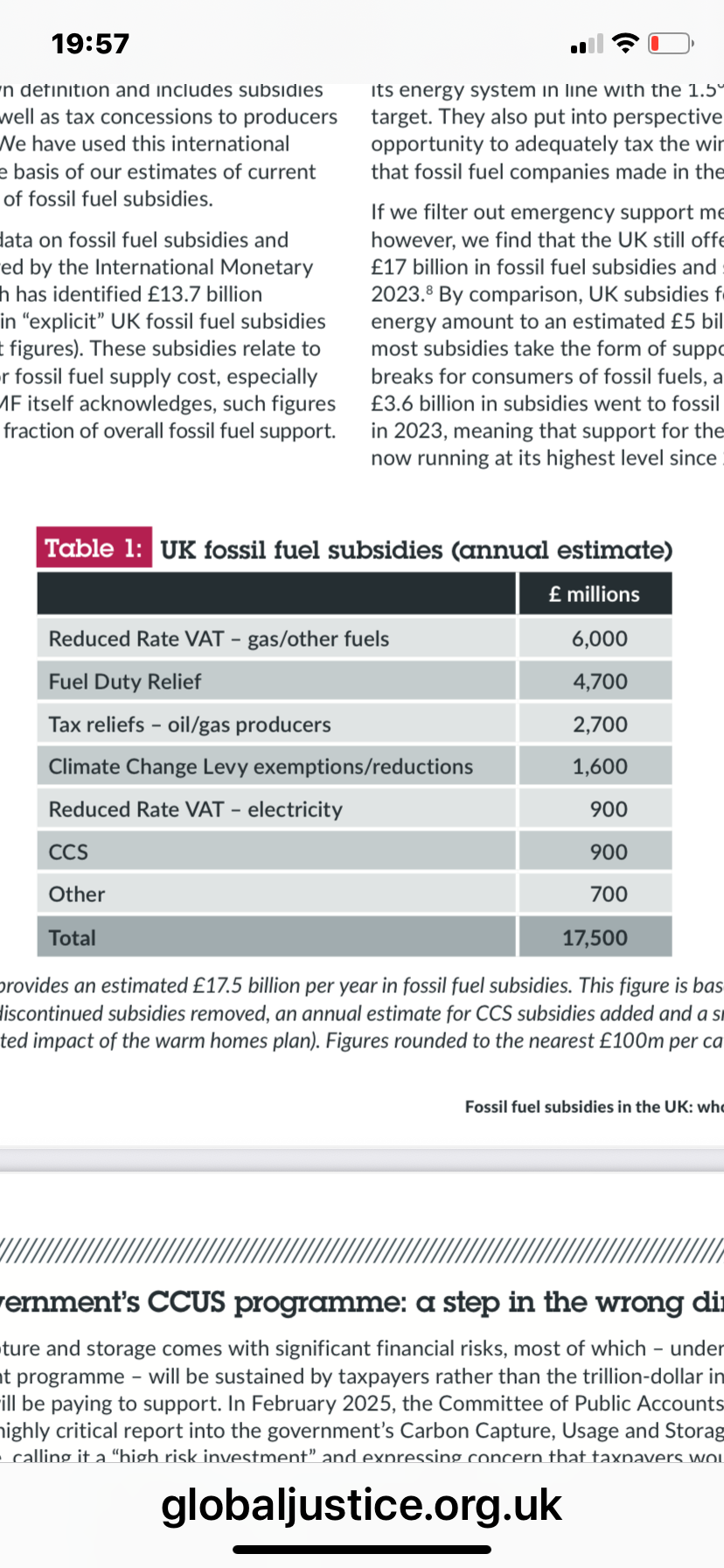

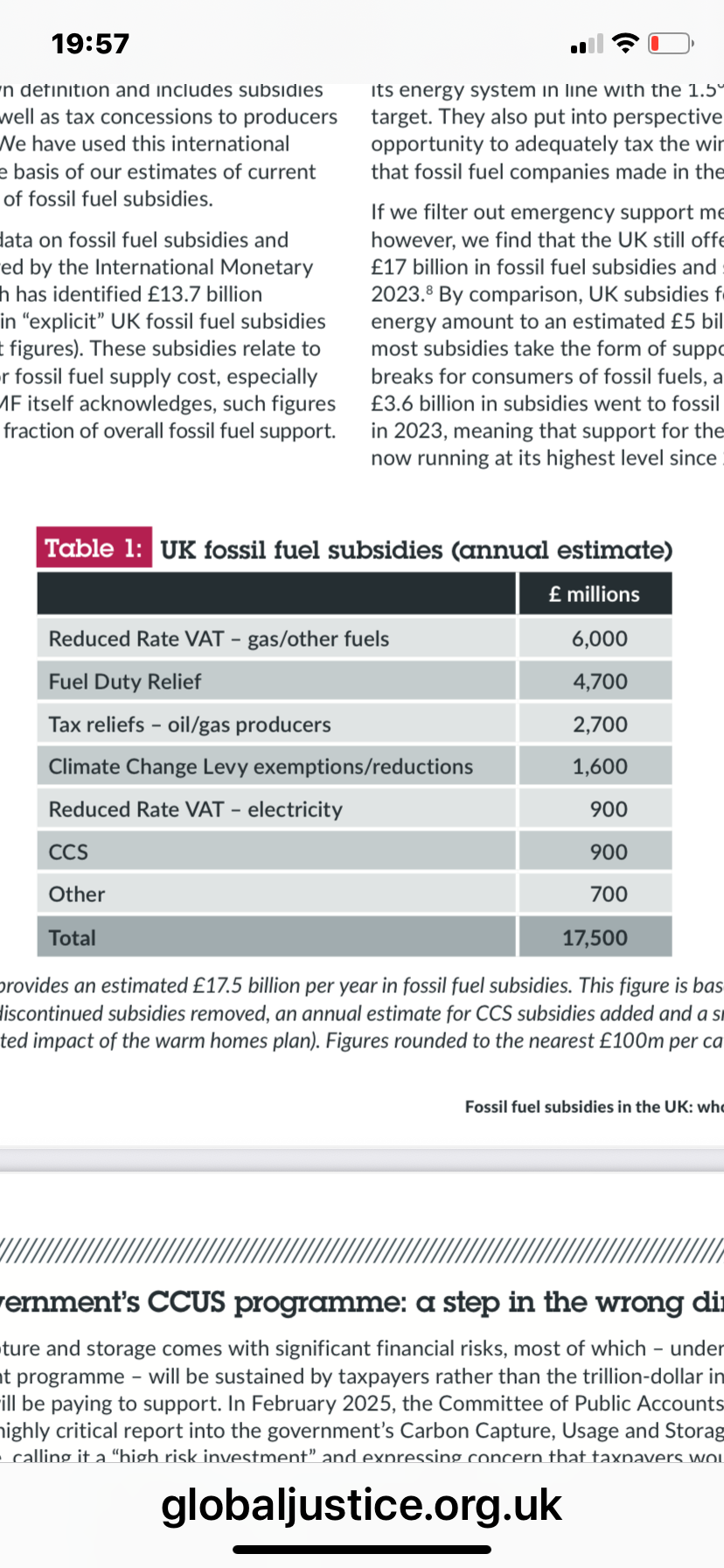

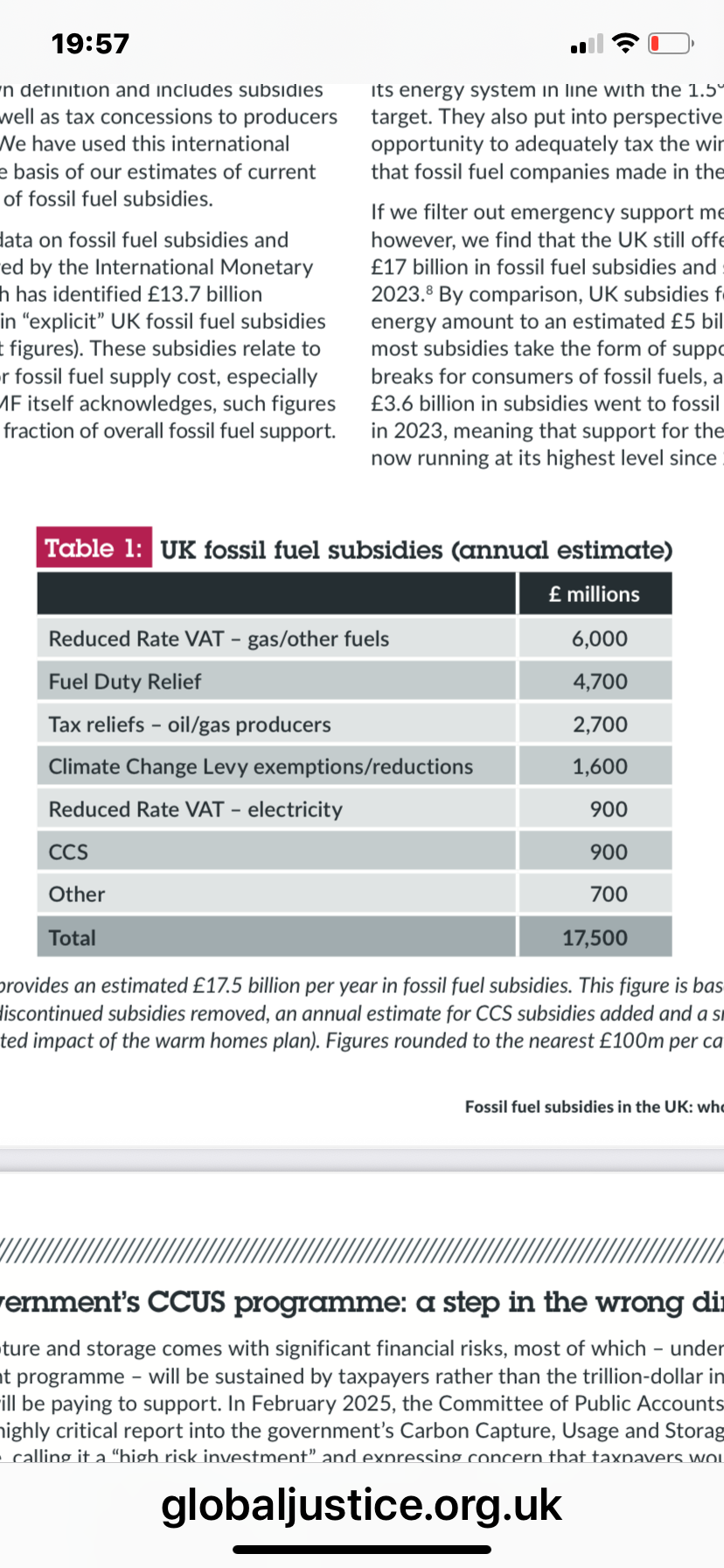

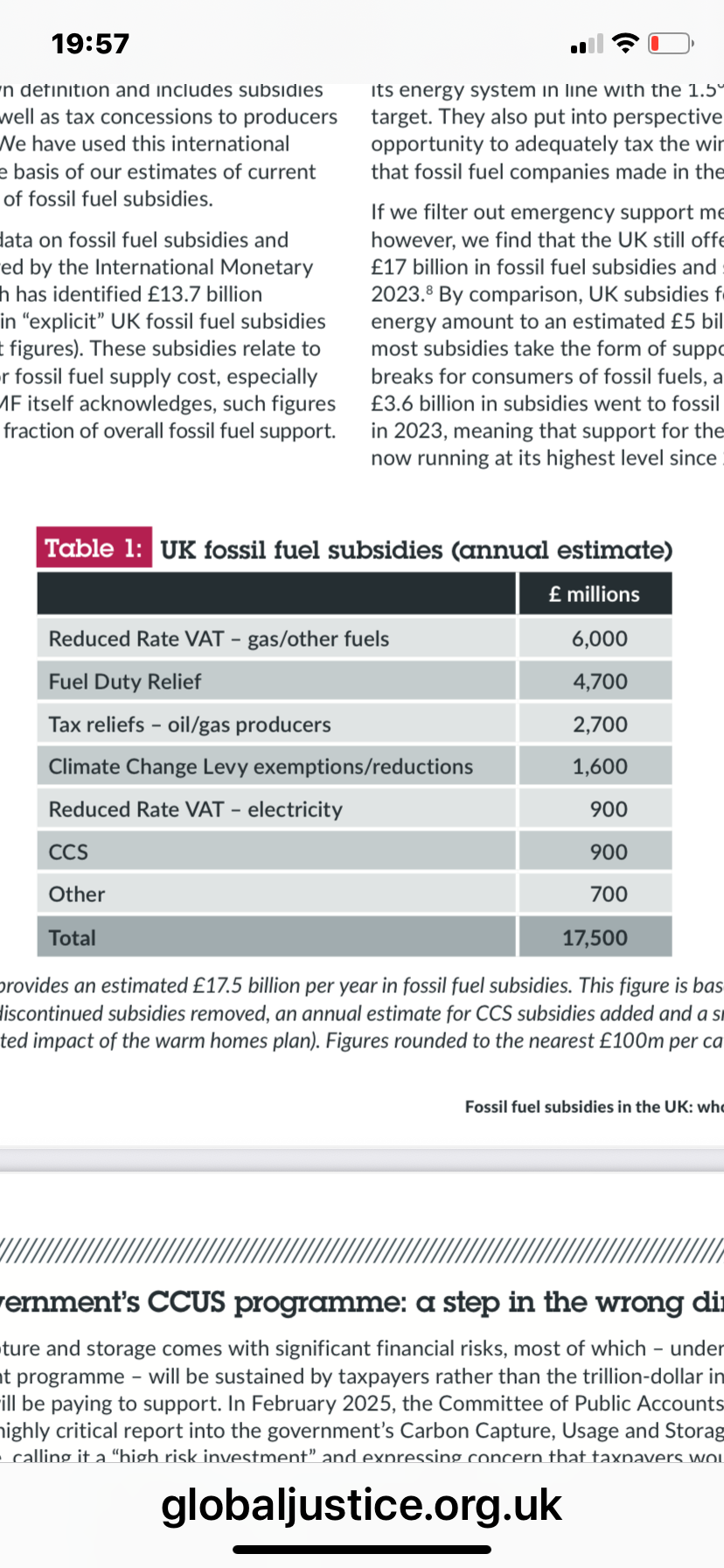

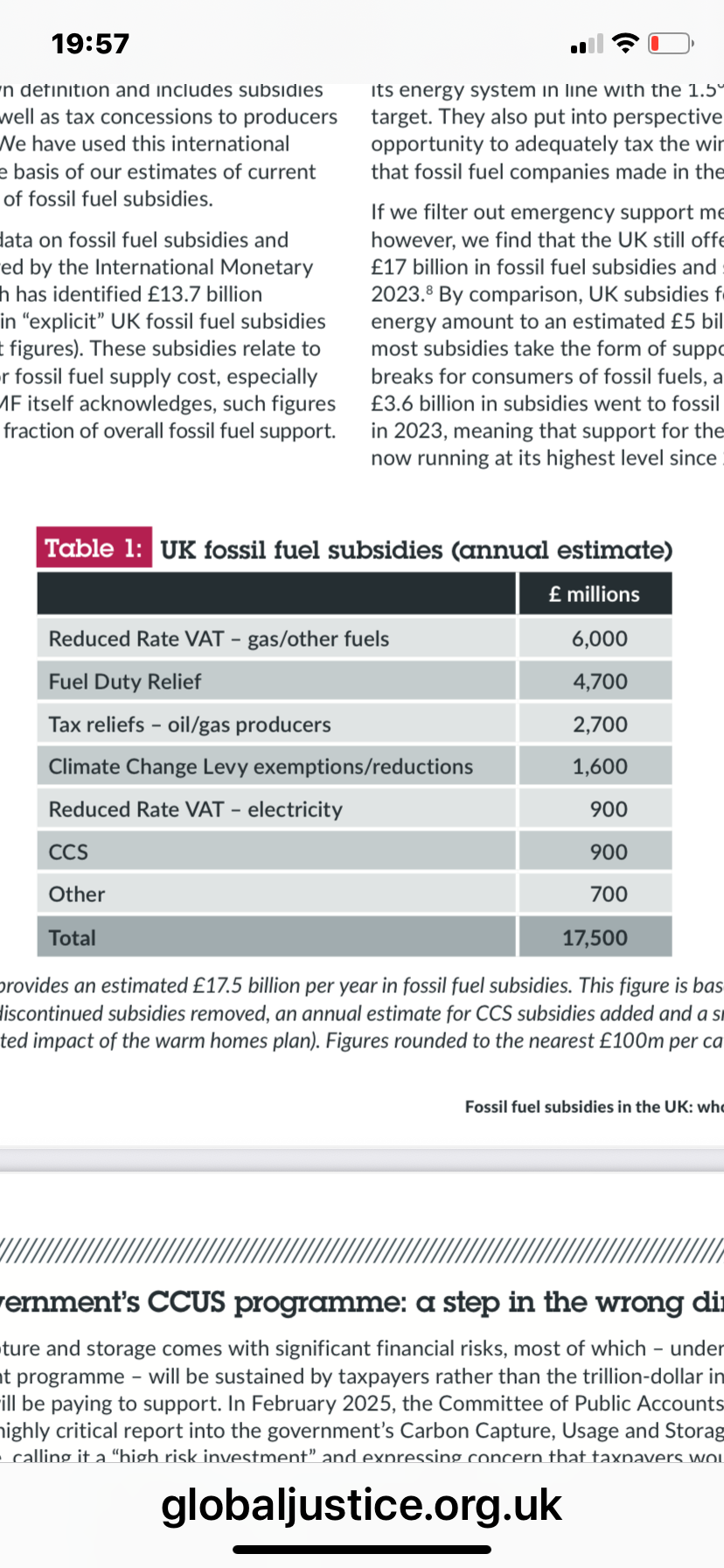

£2.4bn last year went on subsidies to renewables. Compare that to the £17.5 billion paid out in the same period in UK subsidies to fossil fuel companies (out of £7 trillion globally). These are huge multinationals making tens trillions in profit not innovating and not developing new technology or a public good. So no reason for these subsidies.It's is only by choice that the government puts the cost for one of these onto the consumers bills and the other is paid for out of general taxation. Imagine if the fossil fuel subsidies had always been paid for out of bills. Imagine the outrage. We would all be calling for renewables. But because that is indirectly paid and more murky no one seems up in arms.The research used the OECD definition of subsidies which encompasses:

- Tax relief schemes given to fossil fuel companies, including special ‘ring fence corporation tax’ rules that allow them to deduct capital investment (purchases of new assets and equipment) from the overall amount that is liable for corporation tax

- Financial support for the fossil fuel industry to invest in projects that allow for the continued production of fossil fuels – such as the government’s Carbon Capture, Usage and Storage Programme

- Measures taken by governments to artificially lower the price of coal, oil or natural gas, including the Reduced Rate of VAT for Domestic Fuel and Power.

2 -

I don't believe those make up that large a proportion of it. Either way none of it would be necessary with Net Zero. So still a massive saving on subsidies if we phase out fossil fuelsvalleynick66 said:

It’s a hugely complex market. But these notes on the article do add some perspective ie it’s not a simple cash giveaway :ME14addick said:

Thanks for posting, subsidising fossil fuels, when they make such huge profits is absolutely crazy.cantersaddick said:

The subsidies point is a rather frustrating misleading one though.ForestHillAddick said:Just to weigh in on this, the average UK energy bill is made up of 3 components:

1. Wholesale energy prices, for gas it's dependent on international markets mainly, for power is more dependent on gas price + domestic wind/solar production

2. Transportation and balancing costs, it takes money to maintain all the pilons and gas pipes without anything exploding

3. Subsidies, it also cost money to convince renewable developers to build their wind/solar sites in the UK, this money doesn't come from tax revenues, it gets added to end user bills instead

So just because wholesale prices drop, does not mean end user bills drop, in fact, by increasing renewable generation, you increase balancing and subsidy costs, so numbers 2 and 3 above will increase, whilst number 1 decreases.

The road to net 0 will not decrease bills in the next 20 years, it'll decrease bills after that in general, and hopefully environmental damage.

In my opinion, it's a price we have to pay now for future generations.

£2.4bn last year went on subsidies to renewables. Compare that to the £17.5 billion paid out in the same period in UK subsidies to fossil fuel companies (out of £7 trillion globally). These are huge multinationals making tens trillions in profit not innovating and not developing new technology or a public good. So no reason for these subsidies.It's is only by choice that the government puts the cost for one of these onto the consumers bills and the other is paid for out of general taxation. Imagine if the fossil fuel subsidies had always been paid for out of bills. Imagine the outrage. We would all be calling for renewables. But because that is indirectly paid and more murky no one seems up in arms.The research used the OECD definition of subsidies which encompasses:

- Tax relief schemes given to fossil fuel companies, including special ‘ring fence corporation tax’ rules that allow them to deduct capital investment (purchases of new assets and equipment) from the overall amount that is liable for corporation tax

- Financial support for the fossil fuel industry to invest in projects that allow for the continued production of fossil fuels – such as the government’s Carbon Capture, Usage and Storage Programme

- Measures taken by governments to artificially lower the price of coal, oil or natural gas, including the Reduced Rate of VAT for Domestic Fuel and Power.

1 -

I'm massively supportive of renewable and can't wait until we are net zero but I hate this kind of dishonest propaganda. The first is a tax break available to literally all companies. The second is support for carbon capture not production of fossil fuels. Utterly dishonest to conflate the two. The third is a benefit to consumers of all energy. It has zero impact on the profitability of fossil fuel companies.

3 -

And which is the direction of travel. ‘Green’ requires investment subsidies first.cantersaddick said:

I don't believe those make up that large a proportion of it. Either way none of it would be necessary with Net Zero. So still a massive saving on subsidies if we phase out fossil fuelsvalleynick66 said:

It’s a hugely complex market. But these notes on the article do add some perspective ie it’s not a simple cash giveaway :ME14addick said:

Thanks for posting, subsidising fossil fuels, when they make such huge profits is absolutely crazy.cantersaddick said:

The subsidies point is a rather frustrating misleading one though.ForestHillAddick said:Just to weigh in on this, the average UK energy bill is made up of 3 components:

1. Wholesale energy prices, for gas it's dependent on international markets mainly, for power is more dependent on gas price + domestic wind/solar production

2. Transportation and balancing costs, it takes money to maintain all the pilons and gas pipes without anything exploding

3. Subsidies, it also cost money to convince renewable developers to build their wind/solar sites in the UK, this money doesn't come from tax revenues, it gets added to end user bills instead

So just because wholesale prices drop, does not mean end user bills drop, in fact, by increasing renewable generation, you increase balancing and subsidy costs, so numbers 2 and 3 above will increase, whilst number 1 decreases.

The road to net 0 will not decrease bills in the next 20 years, it'll decrease bills after that in general, and hopefully environmental damage.

In my opinion, it's a price we have to pay now for future generations.

£2.4bn last year went on subsidies to renewables. Compare that to the £17.5 billion paid out in the same period in UK subsidies to fossil fuel companies (out of £7 trillion globally). These are huge multinationals making tens trillions in profit not innovating and not developing new technology or a public good. So no reason for these subsidies.It's is only by choice that the government puts the cost for one of these onto the consumers bills and the other is paid for out of general taxation. Imagine if the fossil fuel subsidies had always been paid for out of bills. Imagine the outrage. We would all be calling for renewables. But because that is indirectly paid and more murky no one seems up in arms.The research used the OECD definition of subsidies which encompasses:

- Tax relief schemes given to fossil fuel companies, including special ‘ring fence corporation tax’ rules that allow them to deduct capital investment (purchases of new assets and equipment) from the overall amount that is liable for corporation tax

- Financial support for the fossil fuel industry to invest in projects that allow for the continued production of fossil fuels – such as the government’s Carbon Capture, Usage and Storage Programme

- Measures taken by governments to artificially lower the price of coal, oil or natural gas, including the Reduced Rate of VAT for Domestic Fuel and Power.

The speed of change is a whole other story.Though why you don’t believe ‘they don’t make up a large proportion’ I’m not sure. The report sats(as I read it) £6.9b is down to VAT. 0

0 -

Net zero requires carbon capture. The clue is in the "net"cantersaddick said:

I don't believe those make up that large a proportion of it. Either way none of it would be necessary with Net Zero. So still a massive saving on subsidies if we phase out fossil fuelsvalleynick66 said:

It’s a hugely complex market. But these notes on the article do add some perspective ie it’s not a simple cash giveaway :ME14addick said:

Thanks for posting, subsidising fossil fuels, when they make such huge profits is absolutely crazy.cantersaddick said:

The subsidies point is a rather frustrating misleading one though.ForestHillAddick said:Just to weigh in on this, the average UK energy bill is made up of 3 components:

1. Wholesale energy prices, for gas it's dependent on international markets mainly, for power is more dependent on gas price + domestic wind/solar production

2. Transportation and balancing costs, it takes money to maintain all the pilons and gas pipes without anything exploding

3. Subsidies, it also cost money to convince renewable developers to build their wind/solar sites in the UK, this money doesn't come from tax revenues, it gets added to end user bills instead

So just because wholesale prices drop, does not mean end user bills drop, in fact, by increasing renewable generation, you increase balancing and subsidy costs, so numbers 2 and 3 above will increase, whilst number 1 decreases.

The road to net 0 will not decrease bills in the next 20 years, it'll decrease bills after that in general, and hopefully environmental damage.

In my opinion, it's a price we have to pay now for future generations.

£2.4bn last year went on subsidies to renewables. Compare that to the £17.5 billion paid out in the same period in UK subsidies to fossil fuel companies (out of £7 trillion globally). These are huge multinationals making tens trillions in profit not innovating and not developing new technology or a public good. So no reason for these subsidies.It's is only by choice that the government puts the cost for one of these onto the consumers bills and the other is paid for out of general taxation. Imagine if the fossil fuel subsidies had always been paid for out of bills. Imagine the outrage. We would all be calling for renewables. But because that is indirectly paid and more murky no one seems up in arms.The research used the OECD definition of subsidies which encompasses:

- Tax relief schemes given to fossil fuel companies, including special ‘ring fence corporation tax’ rules that allow them to deduct capital investment (purchases of new assets and equipment) from the overall amount that is liable for corporation tax

- Financial support for the fossil fuel industry to invest in projects that allow for the continued production of fossil fuels – such as the government’s Carbon Capture, Usage and Storage Programme

- Measures taken by governments to artificially lower the price of coal, oil or natural gas, including the Reduced Rate of VAT for Domestic Fuel and Power.

1 -

I think important to note, the VAT 'subsidy' doesn't actually affect the fossil fuel companies, VAT is only paid by the end user, so the producers and whole sellers aren't ultimately liable for it.valleynick66 said:

And which is the direction of travel. ‘Green’ requires investment subsidies first.cantersaddick said:

I don't believe those make up that large a proportion of it. Either way none of it would be necessary with Net Zero. So still a massive saving on subsidies if we phase out fossil fuelsvalleynick66 said:

It’s a hugely complex market. But these notes on the article do add some perspective ie it’s not a simple cash giveaway :ME14addick said:

Thanks for posting, subsidising fossil fuels, when they make such huge profits is absolutely crazy.cantersaddick said:

The subsidies point is a rather frustrating misleading one though.ForestHillAddick said:Just to weigh in on this, the average UK energy bill is made up of 3 components:

1. Wholesale energy prices, for gas it's dependent on international markets mainly, for power is more dependent on gas price + domestic wind/solar production

2. Transportation and balancing costs, it takes money to maintain all the pilons and gas pipes without anything exploding

3. Subsidies, it also cost money to convince renewable developers to build their wind/solar sites in the UK, this money doesn't come from tax revenues, it gets added to end user bills instead

So just because wholesale prices drop, does not mean end user bills drop, in fact, by increasing renewable generation, you increase balancing and subsidy costs, so numbers 2 and 3 above will increase, whilst number 1 decreases.

The road to net 0 will not decrease bills in the next 20 years, it'll decrease bills after that in general, and hopefully environmental damage.

In my opinion, it's a price we have to pay now for future generations.

£2.4bn last year went on subsidies to renewables. Compare that to the £17.5 billion paid out in the same period in UK subsidies to fossil fuel companies (out of £7 trillion globally). These are huge multinationals making tens trillions in profit not innovating and not developing new technology or a public good. So no reason for these subsidies.It's is only by choice that the government puts the cost for one of these onto the consumers bills and the other is paid for out of general taxation. Imagine if the fossil fuel subsidies had always been paid for out of bills. Imagine the outrage. We would all be calling for renewables. But because that is indirectly paid and more murky no one seems up in arms.The research used the OECD definition of subsidies which encompasses:

- Tax relief schemes given to fossil fuel companies, including special ‘ring fence corporation tax’ rules that allow them to deduct capital investment (purchases of new assets and equipment) from the overall amount that is liable for corporation tax

- Financial support for the fossil fuel industry to invest in projects that allow for the continued production of fossil fuels – such as the government’s Carbon Capture, Usage and Storage Programme

- Measures taken by governments to artificially lower the price of coal, oil or natural gas, including the Reduced Rate of VAT for Domestic Fuel and Power.

The speed of change is a whole other story.Though why you don’t believe ‘they don’t make up a large proportion’ I’m not sure. The report sats(as I read it) £6.9b is down to VAT.

I believe the amount in that source is due to VAT only being 5% on domestic gas bills, were they to end that then VAT would become 20% on gas bills, all paid for by the end users.

0 -

Exactly. That’s my point.ForestHillAddick said:

I think important to note, the VAT 'subsidy' doesn't actually affect the fossil fuel companies, VAT is only paid by the end user, so the producers and whole sellers aren't ultimately liable for it.valleynick66 said:

And which is the direction of travel. ‘Green’ requires investment subsidies first.cantersaddick said:

I don't believe those make up that large a proportion of it. Either way none of it would be necessary with Net Zero. So still a massive saving on subsidies if we phase out fossil fuelsvalleynick66 said:

It’s a hugely complex market. But these notes on the article do add some perspective ie it’s not a simple cash giveaway :ME14addick said:

Thanks for posting, subsidising fossil fuels, when they make such huge profits is absolutely crazy.cantersaddick said:

The subsidies point is a rather frustrating misleading one though.ForestHillAddick said:Just to weigh in on this, the average UK energy bill is made up of 3 components:

1. Wholesale energy prices, for gas it's dependent on international markets mainly, for power is more dependent on gas price + domestic wind/solar production

2. Transportation and balancing costs, it takes money to maintain all the pilons and gas pipes without anything exploding

3. Subsidies, it also cost money to convince renewable developers to build their wind/solar sites in the UK, this money doesn't come from tax revenues, it gets added to end user bills instead

So just because wholesale prices drop, does not mean end user bills drop, in fact, by increasing renewable generation, you increase balancing and subsidy costs, so numbers 2 and 3 above will increase, whilst number 1 decreases.

The road to net 0 will not decrease bills in the next 20 years, it'll decrease bills after that in general, and hopefully environmental damage.

In my opinion, it's a price we have to pay now for future generations.

£2.4bn last year went on subsidies to renewables. Compare that to the £17.5 billion paid out in the same period in UK subsidies to fossil fuel companies (out of £7 trillion globally). These are huge multinationals making tens trillions in profit not innovating and not developing new technology or a public good. So no reason for these subsidies.It's is only by choice that the government puts the cost for one of these onto the consumers bills and the other is paid for out of general taxation. Imagine if the fossil fuel subsidies had always been paid for out of bills. Imagine the outrage. We would all be calling for renewables. But because that is indirectly paid and more murky no one seems up in arms.The research used the OECD definition of subsidies which encompasses:

- Tax relief schemes given to fossil fuel companies, including special ‘ring fence corporation tax’ rules that allow them to deduct capital investment (purchases of new assets and equipment) from the overall amount that is liable for corporation tax

- Financial support for the fossil fuel industry to invest in projects that allow for the continued production of fossil fuels – such as the government’s Carbon Capture, Usage and Storage Programme

- Measures taken by governments to artificially lower the price of coal, oil or natural gas, including the Reduced Rate of VAT for Domestic Fuel and Power.

The speed of change is a whole other story.Though why you don’t believe ‘they don’t make up a large proportion’ I’m not sure. The report sats(as I read it) £6.9b is down to VAT.

I believe the amount in that source is due to VAT only being 5% on domestic gas bills, were they to end that then VAT would become 20% on gas bills, all paid for by the end users.The headline of subsidies implies to the benefit of the multi national / large corporate whereas it’s the consumer benefiting.Dangerous headline statement.1 -

Yep sorry, I got a bit lost in the chain of comments.valleynick66 said:

Exactly. That’s my point.ForestHillAddick said:

I think important to note, the VAT 'subsidy' doesn't actually affect the fossil fuel companies, VAT is only paid by the end user, so the producers and whole sellers aren't ultimately liable for it.valleynick66 said:

And which is the direction of travel. ‘Green’ requires investment subsidies first.cantersaddick said:

I don't believe those make up that large a proportion of it. Either way none of it would be necessary with Net Zero. So still a massive saving on subsidies if we phase out fossil fuelsvalleynick66 said:

It’s a hugely complex market. But these notes on the article do add some perspective ie it’s not a simple cash giveaway :ME14addick said:

Thanks for posting, subsidising fossil fuels, when they make such huge profits is absolutely crazy.cantersaddick said:

The subsidies point is a rather frustrating misleading one though.ForestHillAddick said:Just to weigh in on this, the average UK energy bill is made up of 3 components:

1. Wholesale energy prices, for gas it's dependent on international markets mainly, for power is more dependent on gas price + domestic wind/solar production

2. Transportation and balancing costs, it takes money to maintain all the pilons and gas pipes without anything exploding

3. Subsidies, it also cost money to convince renewable developers to build their wind/solar sites in the UK, this money doesn't come from tax revenues, it gets added to end user bills instead

So just because wholesale prices drop, does not mean end user bills drop, in fact, by increasing renewable generation, you increase balancing and subsidy costs, so numbers 2 and 3 above will increase, whilst number 1 decreases.

The road to net 0 will not decrease bills in the next 20 years, it'll decrease bills after that in general, and hopefully environmental damage.

In my opinion, it's a price we have to pay now for future generations.

£2.4bn last year went on subsidies to renewables. Compare that to the £17.5 billion paid out in the same period in UK subsidies to fossil fuel companies (out of £7 trillion globally). These are huge multinationals making tens trillions in profit not innovating and not developing new technology or a public good. So no reason for these subsidies.It's is only by choice that the government puts the cost for one of these onto the consumers bills and the other is paid for out of general taxation. Imagine if the fossil fuel subsidies had always been paid for out of bills. Imagine the outrage. We would all be calling for renewables. But because that is indirectly paid and more murky no one seems up in arms.The research used the OECD definition of subsidies which encompasses:

- Tax relief schemes given to fossil fuel companies, including special ‘ring fence corporation tax’ rules that allow them to deduct capital investment (purchases of new assets and equipment) from the overall amount that is liable for corporation tax

- Financial support for the fossil fuel industry to invest in projects that allow for the continued production of fossil fuels – such as the government’s Carbon Capture, Usage and Storage Programme

- Measures taken by governments to artificially lower the price of coal, oil or natural gas, including the Reduced Rate of VAT for Domestic Fuel and Power.

The speed of change is a whole other story.Though why you don’t believe ‘they don’t make up a large proportion’ I’m not sure. The report sats(as I read it) £6.9b is down to VAT.

I believe the amount in that source is due to VAT only being 5% on domestic gas bills, were they to end that then VAT would become 20% on gas bills, all paid for by the end users.The headline of subsidies implies to the benefit of the multi national / large corporate whereas it’s the consumer benefiting.Dangerous headline statement.

Definitely in agreement on this.1 -

Yes to an extent in the short term - long term decarbonisation is possible to the point where capture isn't needed. Capture is only ever a short term solution. and the vast majority of it is on the "renewable" side of the equation. Both in terms of who is doing it and where its funded. It doesn't need subsidies to fossil fuel giants to make it happen.Jints said:

Net zero requires carbon capture. The clue is in the "net"cantersaddick said:

I don't believe those make up that large a proportion of it. Either way none of it would be necessary with Net Zero. So still a massive saving on subsidies if we phase out fossil fuelsvalleynick66 said:

It’s a hugely complex market. But these notes on the article do add some perspective ie it’s not a simple cash giveaway :ME14addick said:

Thanks for posting, subsidising fossil fuels, when they make such huge profits is absolutely crazy.cantersaddick said:

The subsidies point is a rather frustrating misleading one though.ForestHillAddick said:Just to weigh in on this, the average UK energy bill is made up of 3 components:

1. Wholesale energy prices, for gas it's dependent on international markets mainly, for power is more dependent on gas price + domestic wind/solar production

2. Transportation and balancing costs, it takes money to maintain all the pilons and gas pipes without anything exploding

3. Subsidies, it also cost money to convince renewable developers to build their wind/solar sites in the UK, this money doesn't come from tax revenues, it gets added to end user bills instead

So just because wholesale prices drop, does not mean end user bills drop, in fact, by increasing renewable generation, you increase balancing and subsidy costs, so numbers 2 and 3 above will increase, whilst number 1 decreases.

The road to net 0 will not decrease bills in the next 20 years, it'll decrease bills after that in general, and hopefully environmental damage.

In my opinion, it's a price we have to pay now for future generations.

£2.4bn last year went on subsidies to renewables. Compare that to the £17.5 billion paid out in the same period in UK subsidies to fossil fuel companies (out of £7 trillion globally). These are huge multinationals making tens trillions in profit not innovating and not developing new technology or a public good. So no reason for these subsidies.It's is only by choice that the government puts the cost for one of these onto the consumers bills and the other is paid for out of general taxation. Imagine if the fossil fuel subsidies had always been paid for out of bills. Imagine the outrage. We would all be calling for renewables. But because that is indirectly paid and more murky no one seems up in arms.The research used the OECD definition of subsidies which encompasses:

- Tax relief schemes given to fossil fuel companies, including special ‘ring fence corporation tax’ rules that allow them to deduct capital investment (purchases of new assets and equipment) from the overall amount that is liable for corporation tax

- Financial support for the fossil fuel industry to invest in projects that allow for the continued production of fossil fuels – such as the government’s Carbon Capture, Usage and Storage Programme

- Measures taken by governments to artificially lower the price of coal, oil or natural gas, including the Reduced Rate of VAT for Domestic Fuel and Power.

1 -

That VAT "subsidy" figure is bollocks.ForestHillAddick said:

Yep sorry, I got a bit lost in the chain of comments.valleynick66 said:

Exactly. That’s my point.ForestHillAddick said:

I think important to note, the VAT 'subsidy' doesn't actually affect the fossil fuel companies, VAT is only paid by the end user, so the producers and whole sellers aren't ultimately liable for it.valleynick66 said:

And which is the direction of travel. ‘Green’ requires investment subsidies first.cantersaddick said:

I don't believe those make up that large a proportion of it. Either way none of it would be necessary with Net Zero. So still a massive saving on subsidies if we phase out fossil fuelsvalleynick66 said:

It’s a hugely complex market. But these notes on the article do add some perspective ie it’s not a simple cash giveaway :ME14addick said:

Thanks for posting, subsidising fossil fuels, when they make such huge profits is absolutely crazy.cantersaddick said:

The subsidies point is a rather frustrating misleading one though.ForestHillAddick said:Just to weigh in on this, the average UK energy bill is made up of 3 components:

1. Wholesale energy prices, for gas it's dependent on international markets mainly, for power is more dependent on gas price + domestic wind/solar production

2. Transportation and balancing costs, it takes money to maintain all the pilons and gas pipes without anything exploding

3. Subsidies, it also cost money to convince renewable developers to build their wind/solar sites in the UK, this money doesn't come from tax revenues, it gets added to end user bills instead

So just because wholesale prices drop, does not mean end user bills drop, in fact, by increasing renewable generation, you increase balancing and subsidy costs, so numbers 2 and 3 above will increase, whilst number 1 decreases.

The road to net 0 will not decrease bills in the next 20 years, it'll decrease bills after that in general, and hopefully environmental damage.

In my opinion, it's a price we have to pay now for future generations.

£2.4bn last year went on subsidies to renewables. Compare that to the £17.5 billion paid out in the same period in UK subsidies to fossil fuel companies (out of £7 trillion globally). These are huge multinationals making tens trillions in profit not innovating and not developing new technology or a public good. So no reason for these subsidies.It's is only by choice that the government puts the cost for one of these onto the consumers bills and the other is paid for out of general taxation. Imagine if the fossil fuel subsidies had always been paid for out of bills. Imagine the outrage. We would all be calling for renewables. But because that is indirectly paid and more murky no one seems up in arms.The research used the OECD definition of subsidies which encompasses:

- Tax relief schemes given to fossil fuel companies, including special ‘ring fence corporation tax’ rules that allow them to deduct capital investment (purchases of new assets and equipment) from the overall amount that is liable for corporation tax

- Financial support for the fossil fuel industry to invest in projects that allow for the continued production of fossil fuels – such as the government’s Carbon Capture, Usage and Storage Programme

- Measures taken by governments to artificially lower the price of coal, oil or natural gas, including the Reduced Rate of VAT for Domestic Fuel and Power.

The speed of change is a whole other story.Though why you don’t believe ‘they don’t make up a large proportion’ I’m not sure. The report sats(as I read it) £6.9b is down to VAT.

I believe the amount in that source is due to VAT only being 5% on domestic gas bills, were they to end that then VAT would become 20% on gas bills, all paid for by the end users.The headline of subsidies implies to the benefit of the multi national / large corporate whereas it’s the consumer benefiting.Dangerous headline statement.

Definitely in agreement on this.

Sure, a government could decide to whack up VAT on domestic fuel to 20%, but the fact they haven't hardly amounts to a subsidy. I mean, if we're going down that route you could also say the government "subsidises" the food industry, because most food is zero-rated. Or the book industry, for the same reason. Or maybe it subsidises private landlords because residential rents are exempt. As are funerals.

Someone will be claiming VAT's a "tariff" next.0 -

Sponsored links:

-

To be fair it's not saying all VAT is included just VAT relief. It is an OECD measure of subsidies so whilst maybe not perfect it is clearly a recognised and comparable metric.Off_it said:

That VAT "subsidy" figure is bollocks.ForestHillAddick said:

Yep sorry, I got a bit lost in the chain of comments.valleynick66 said:

Exactly. That’s my point.ForestHillAddick said:

I think important to note, the VAT 'subsidy' doesn't actually affect the fossil fuel companies, VAT is only paid by the end user, so the producers and whole sellers aren't ultimately liable for it.valleynick66 said:

And which is the direction of travel. ‘Green’ requires investment subsidies first.cantersaddick said:

I don't believe those make up that large a proportion of it. Either way none of it would be necessary with Net Zero. So still a massive saving on subsidies if we phase out fossil fuelsvalleynick66 said:

It’s a hugely complex market. But these notes on the article do add some perspective ie it’s not a simple cash giveaway :ME14addick said:

Thanks for posting, subsidising fossil fuels, when they make such huge profits is absolutely crazy.cantersaddick said:

The subsidies point is a rather frustrating misleading one though.ForestHillAddick said:Just to weigh in on this, the average UK energy bill is made up of 3 components:

1. Wholesale energy prices, for gas it's dependent on international markets mainly, for power is more dependent on gas price + domestic wind/solar production

2. Transportation and balancing costs, it takes money to maintain all the pilons and gas pipes without anything exploding

3. Subsidies, it also cost money to convince renewable developers to build their wind/solar sites in the UK, this money doesn't come from tax revenues, it gets added to end user bills instead

So just because wholesale prices drop, does not mean end user bills drop, in fact, by increasing renewable generation, you increase balancing and subsidy costs, so numbers 2 and 3 above will increase, whilst number 1 decreases.

The road to net 0 will not decrease bills in the next 20 years, it'll decrease bills after that in general, and hopefully environmental damage.

In my opinion, it's a price we have to pay now for future generations.

£2.4bn last year went on subsidies to renewables. Compare that to the £17.5 billion paid out in the same period in UK subsidies to fossil fuel companies (out of £7 trillion globally). These are huge multinationals making tens trillions in profit not innovating and not developing new technology or a public good. So no reason for these subsidies.It's is only by choice that the government puts the cost for one of these onto the consumers bills and the other is paid for out of general taxation. Imagine if the fossil fuel subsidies had always been paid for out of bills. Imagine the outrage. We would all be calling for renewables. But because that is indirectly paid and more murky no one seems up in arms.The research used the OECD definition of subsidies which encompasses:

- Tax relief schemes given to fossil fuel companies, including special ‘ring fence corporation tax’ rules that allow them to deduct capital investment (purchases of new assets and equipment) from the overall amount that is liable for corporation tax

- Financial support for the fossil fuel industry to invest in projects that allow for the continued production of fossil fuels – such as the government’s Carbon Capture, Usage and Storage Programme

- Measures taken by governments to artificially lower the price of coal, oil or natural gas, including the Reduced Rate of VAT for Domestic Fuel and Power.

The speed of change is a whole other story.Though why you don’t believe ‘they don’t make up a large proportion’ I’m not sure. The report sats(as I read it) £6.9b is down to VAT.

I believe the amount in that source is due to VAT only being 5% on domestic gas bills, were they to end that then VAT would become 20% on gas bills, all paid for by the end users.The headline of subsidies implies to the benefit of the multi national / large corporate whereas it’s the consumer benefiting.Dangerous headline statement.

Definitely in agreement on this.

Sure, a government could decide to whack up VAT on domestic fuel to 20%, but the fact they haven't hardly amounts to a subsidy. I mean, if we're going down that route you could also say the government "subsidises" the food industry, because most food is zero-rated. Or the book industry, for the same reason. Or maybe it subsidises private landlords because residential rents are exempt. As are funerals.

Someone will be claiming VAT's a "tariff" next.

0 -

No it's not. We will always need to use fossil fuels for certain products including renewable infrastructure. CCS is necessary to capture the emissions from those processes.cantersaddick said:

Yes to an extent in the short term - long term decarbonisation is possible to the point where capture isn't needed. Capture is only ever a short term solution. and the vast majority of it is on the "renewable" side of the equation. Both in terms of who is doing it and where its funded. It doesn't need subsidies to fossil fuel giants to make it happen.Jints said:

Net zero requires carbon capture. The clue is in the "net"cantersaddick said:

I don't believe those make up that large a proportion of it. Either way none of it would be necessary with Net Zero. So still a massive saving on subsidies if we phase out fossil fuelsvalleynick66 said:

It’s a hugely complex market. But these notes on the article do add some perspective ie it’s not a simple cash giveaway :ME14addick said:

Thanks for posting, subsidising fossil fuels, when they make such huge profits is absolutely crazy.cantersaddick said:

The subsidies point is a rather frustrating misleading one though.ForestHillAddick said:Just to weigh in on this, the average UK energy bill is made up of 3 components:

1. Wholesale energy prices, for gas it's dependent on international markets mainly, for power is more dependent on gas price + domestic wind/solar production

2. Transportation and balancing costs, it takes money to maintain all the pilons and gas pipes without anything exploding

3. Subsidies, it also cost money to convince renewable developers to build their wind/solar sites in the UK, this money doesn't come from tax revenues, it gets added to end user bills instead

So just because wholesale prices drop, does not mean end user bills drop, in fact, by increasing renewable generation, you increase balancing and subsidy costs, so numbers 2 and 3 above will increase, whilst number 1 decreases.

The road to net 0 will not decrease bills in the next 20 years, it'll decrease bills after that in general, and hopefully environmental damage.

In my opinion, it's a price we have to pay now for future generations.

£2.4bn last year went on subsidies to renewables. Compare that to the £17.5 billion paid out in the same period in UK subsidies to fossil fuel companies (out of £7 trillion globally). These are huge multinationals making tens trillions in profit not innovating and not developing new technology or a public good. So no reason for these subsidies.It's is only by choice that the government puts the cost for one of these onto the consumers bills and the other is paid for out of general taxation. Imagine if the fossil fuel subsidies had always been paid for out of bills. Imagine the outrage. We would all be calling for renewables. But because that is indirectly paid and more murky no one seems up in arms.The research used the OECD definition of subsidies which encompasses:

- Tax relief schemes given to fossil fuel companies, including special ‘ring fence corporation tax’ rules that allow them to deduct capital investment (purchases of new assets and equipment) from the overall amount that is liable for corporation tax

- Financial support for the fossil fuel industry to invest in projects that allow for the continued production of fossil fuels – such as the government’s Carbon Capture, Usage and Storage Programme

- Measures taken by governments to artificially lower the price of coal, oil or natural gas, including the Reduced Rate of VAT for Domestic Fuel and Power.

And oil and gas companies aren't promoting CCS projects so they aren't getting subsidies for them.0 -

What VAT "relief" exactly?cantersaddick said:

To be fair it's not saying all VAT is included just VAT relief. It is an OECD measure of subsidies so whilst maybe not perfect it is clearly a recognised and comparable metric.Off_it said:

That VAT "subsidy" figure is bollocks.ForestHillAddick said:

Yep sorry, I got a bit lost in the chain of comments.valleynick66 said:

Exactly. That’s my point.ForestHillAddick said:

I think important to note, the VAT 'subsidy' doesn't actually affect the fossil fuel companies, VAT is only paid by the end user, so the producers and whole sellers aren't ultimately liable for it.valleynick66 said:

And which is the direction of travel. ‘Green’ requires investment subsidies first.cantersaddick said:

I don't believe those make up that large a proportion of it. Either way none of it would be necessary with Net Zero. So still a massive saving on subsidies if we phase out fossil fuelsvalleynick66 said:

It’s a hugely complex market. But these notes on the article do add some perspective ie it’s not a simple cash giveaway :ME14addick said:

Thanks for posting, subsidising fossil fuels, when they make such huge profits is absolutely crazy.cantersaddick said:

The subsidies point is a rather frustrating misleading one though.ForestHillAddick said:Just to weigh in on this, the average UK energy bill is made up of 3 components:

1. Wholesale energy prices, for gas it's dependent on international markets mainly, for power is more dependent on gas price + domestic wind/solar production

2. Transportation and balancing costs, it takes money to maintain all the pilons and gas pipes without anything exploding

3. Subsidies, it also cost money to convince renewable developers to build their wind/solar sites in the UK, this money doesn't come from tax revenues, it gets added to end user bills instead

So just because wholesale prices drop, does not mean end user bills drop, in fact, by increasing renewable generation, you increase balancing and subsidy costs, so numbers 2 and 3 above will increase, whilst number 1 decreases.

The road to net 0 will not decrease bills in the next 20 years, it'll decrease bills after that in general, and hopefully environmental damage.

In my opinion, it's a price we have to pay now for future generations.

£2.4bn last year went on subsidies to renewables. Compare that to the £17.5 billion paid out in the same period in UK subsidies to fossil fuel companies (out of £7 trillion globally). These are huge multinationals making tens trillions in profit not innovating and not developing new technology or a public good. So no reason for these subsidies.It's is only by choice that the government puts the cost for one of these onto the consumers bills and the other is paid for out of general taxation. Imagine if the fossil fuel subsidies had always been paid for out of bills. Imagine the outrage. We would all be calling for renewables. But because that is indirectly paid and more murky no one seems up in arms.The research used the OECD definition of subsidies which encompasses:

- Tax relief schemes given to fossil fuel companies, including special ‘ring fence corporation tax’ rules that allow them to deduct capital investment (purchases of new assets and equipment) from the overall amount that is liable for corporation tax

- Financial support for the fossil fuel industry to invest in projects that allow for the continued production of fossil fuels – such as the government’s Carbon Capture, Usage and Storage Programme

- Measures taken by governments to artificially lower the price of coal, oil or natural gas, including the Reduced Rate of VAT for Domestic Fuel and Power.

The speed of change is a whole other story.Though why you don’t believe ‘they don’t make up a large proportion’ I’m not sure. The report sats(as I read it) £6.9b is down to VAT.

I believe the amount in that source is due to VAT only being 5% on domestic gas bills, were they to end that then VAT would become 20% on gas bills, all paid for by the end users.The headline of subsidies implies to the benefit of the multi national / large corporate whereas it’s the consumer benefiting.Dangerous headline statement.

Definitely in agreement on this.

Sure, a government could decide to whack up VAT on domestic fuel to 20%, but the fact they haven't hardly amounts to a subsidy. I mean, if we're going down that route you could also say the government "subsidises" the food industry, because most food is zero-rated. Or the book industry, for the same reason. Or maybe it subsidises private landlords because residential rents are exempt. As are funerals.

Someone will be claiming VAT's a "tariff" next.

Given the amounts involved it seems the figures are just calculating the difference between VAT at 5% and 20%.

I don't have any skin in this game because, to be honest, I haven't paid enough attention on this thread to work out who is arguing there's a VAT subsidy or why. I'm just saying that because something isn't taxed as much as it could be that doesn't automatically equate to a "subsidy".

1 -

So to the original point are you pro or against this subsidy?cantersaddick said:

To be fair it's not saying all VAT is included just VAT relief. It is an OECD measure of subsidies so whilst maybe not perfect it is clearly a recognised and comparable metric.Off_it said:

That VAT "subsidy" figure is bollocks.ForestHillAddick said:

Yep sorry, I got a bit lost in the chain of comments.valleynick66 said:

Exactly. That’s my point.ForestHillAddick said:

I think important to note, the VAT 'subsidy' doesn't actually affect the fossil fuel companies, VAT is only paid by the end user, so the producers and whole sellers aren't ultimately liable for it.valleynick66 said:

And which is the direction of travel. ‘Green’ requires investment subsidies first.cantersaddick said:

I don't believe those make up that large a proportion of it. Either way none of it would be necessary with Net Zero. So still a massive saving on subsidies if we phase out fossil fuelsvalleynick66 said:

It’s a hugely complex market. But these notes on the article do add some perspective ie it’s not a simple cash giveaway :ME14addick said:

Thanks for posting, subsidising fossil fuels, when they make such huge profits is absolutely crazy.cantersaddick said:

The subsidies point is a rather frustrating misleading one though.ForestHillAddick said:Just to weigh in on this, the average UK energy bill is made up of 3 components:

1. Wholesale energy prices, for gas it's dependent on international markets mainly, for power is more dependent on gas price + domestic wind/solar production

2. Transportation and balancing costs, it takes money to maintain all the pilons and gas pipes without anything exploding

3. Subsidies, it also cost money to convince renewable developers to build their wind/solar sites in the UK, this money doesn't come from tax revenues, it gets added to end user bills instead

So just because wholesale prices drop, does not mean end user bills drop, in fact, by increasing renewable generation, you increase balancing and subsidy costs, so numbers 2 and 3 above will increase, whilst number 1 decreases.

The road to net 0 will not decrease bills in the next 20 years, it'll decrease bills after that in general, and hopefully environmental damage.

In my opinion, it's a price we have to pay now for future generations.

£2.4bn last year went on subsidies to renewables. Compare that to the £17.5 billion paid out in the same period in UK subsidies to fossil fuel companies (out of £7 trillion globally). These are huge multinationals making tens trillions in profit not innovating and not developing new technology or a public good. So no reason for these subsidies.It's is only by choice that the government puts the cost for one of these onto the consumers bills and the other is paid for out of general taxation. Imagine if the fossil fuel subsidies had always been paid for out of bills. Imagine the outrage. We would all be calling for renewables. But because that is indirectly paid and more murky no one seems up in arms.The research used the OECD definition of subsidies which encompasses:

- Tax relief schemes given to fossil fuel companies, including special ‘ring fence corporation tax’ rules that allow them to deduct capital investment (purchases of new assets and equipment) from the overall amount that is liable for corporation tax

- Financial support for the fossil fuel industry to invest in projects that allow for the continued production of fossil fuels – such as the government’s Carbon Capture, Usage and Storage Programme

- Measures taken by governments to artificially lower the price of coal, oil or natural gas, including the Reduced Rate of VAT for Domestic Fuel and Power.

The speed of change is a whole other story.Though why you don’t believe ‘they don’t make up a large proportion’ I’m not sure. The report sats(as I read it) £6.9b is down to VAT.

I believe the amount in that source is due to VAT only being 5% on domestic gas bills, were they to end that then VAT would become 20% on gas bills, all paid for by the end users.The headline of subsidies implies to the benefit of the multi national / large corporate whereas it’s the consumer benefiting.Dangerous headline statement.

Definitely in agreement on this.

Sure, a government could decide to whack up VAT on domestic fuel to 20%, but the fact they haven't hardly amounts to a subsidy. I mean, if we're going down that route you could also say the government "subsidises" the food industry, because most food is zero-rated. Or the book industry, for the same reason. Or maybe it subsidises private landlords because residential rents are exempt. As are funerals.

Someone will be claiming VAT's a "tariff" next.My point remains the headline and subsequent reaction we jump to based on the interpretation of ‘subsidy’ becomes a different story when you look at the scale of this element and who benefits from it.0 -

Global justice now are just a protest group not a serious organisation, don't pay attention to them.

And I agree with net zero/renewables etc massively.0 -

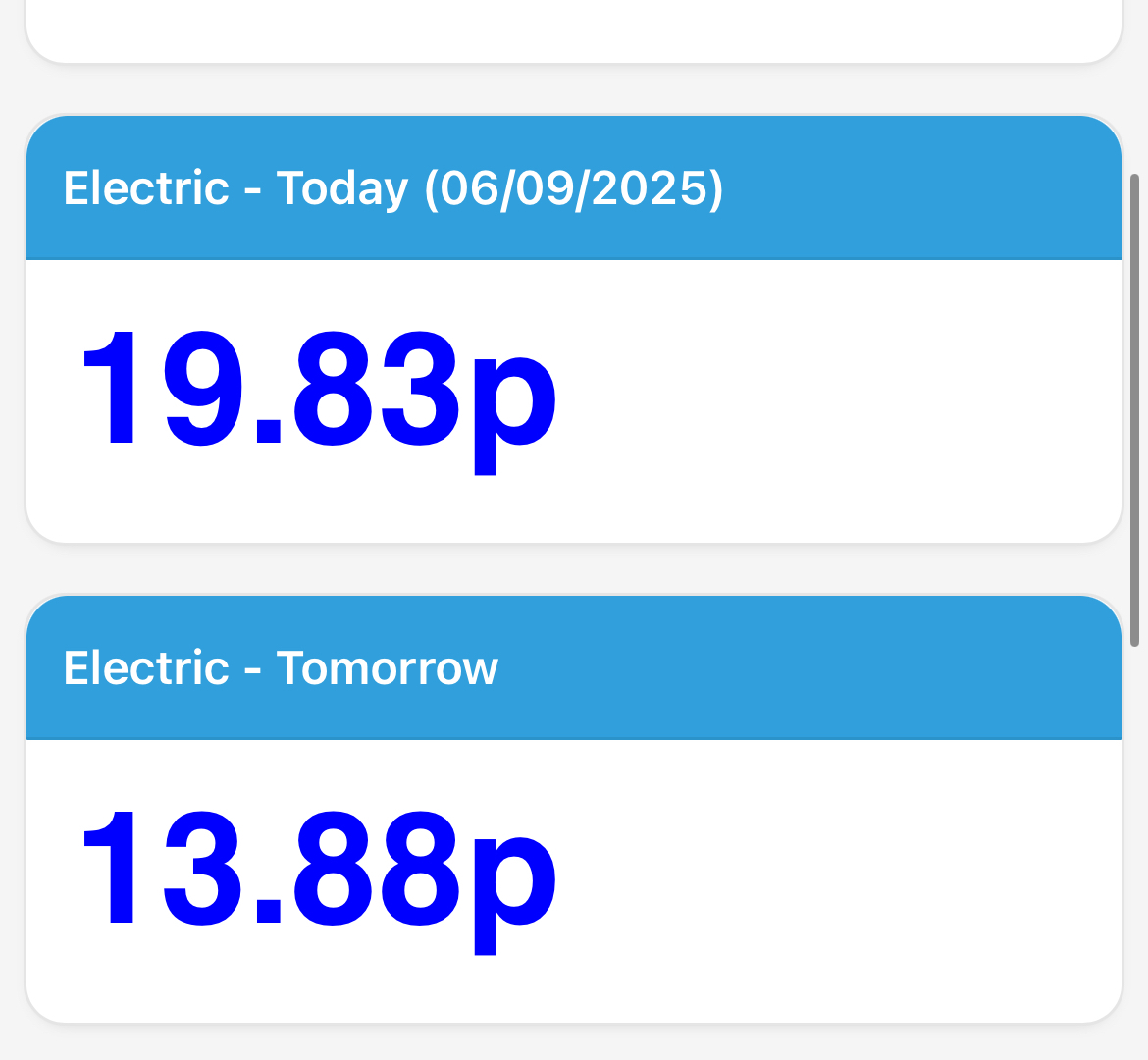

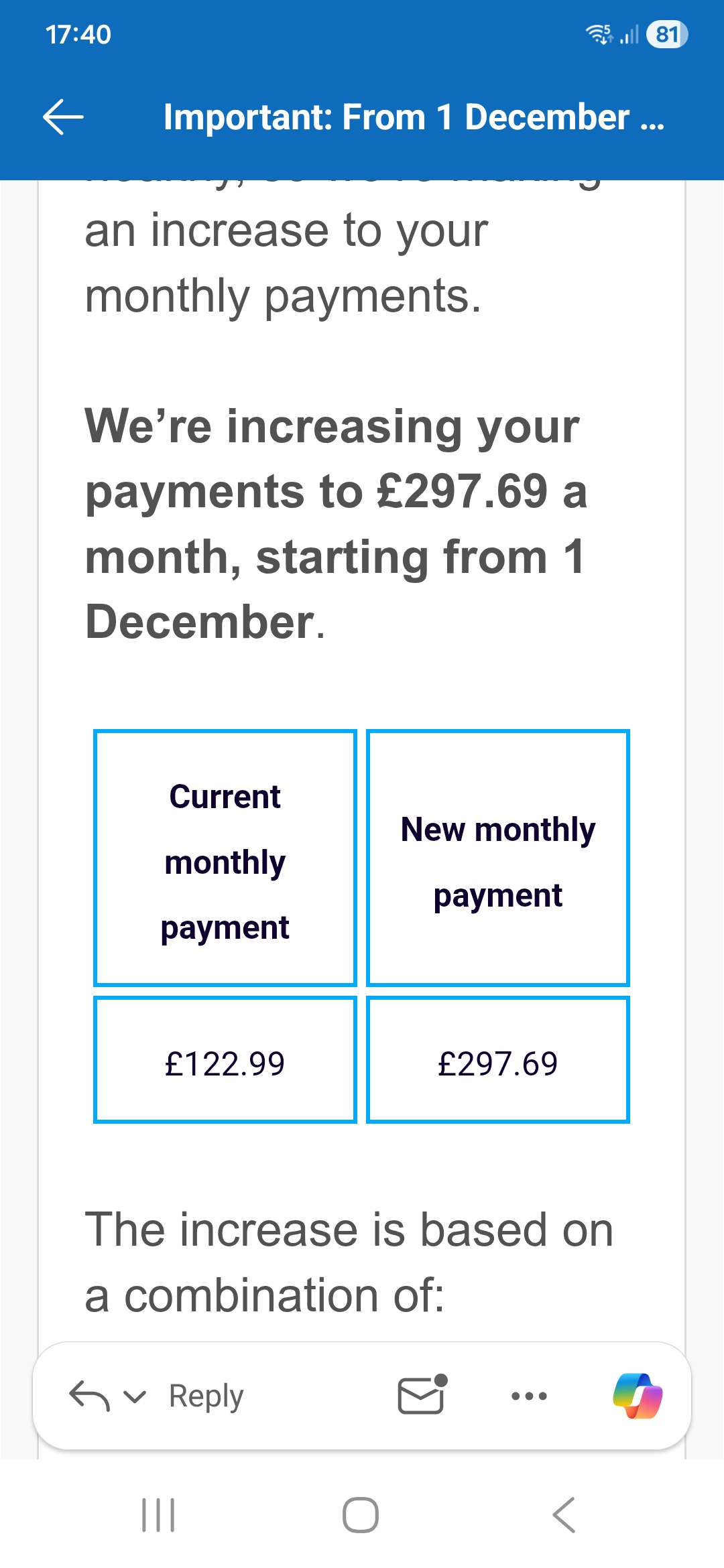

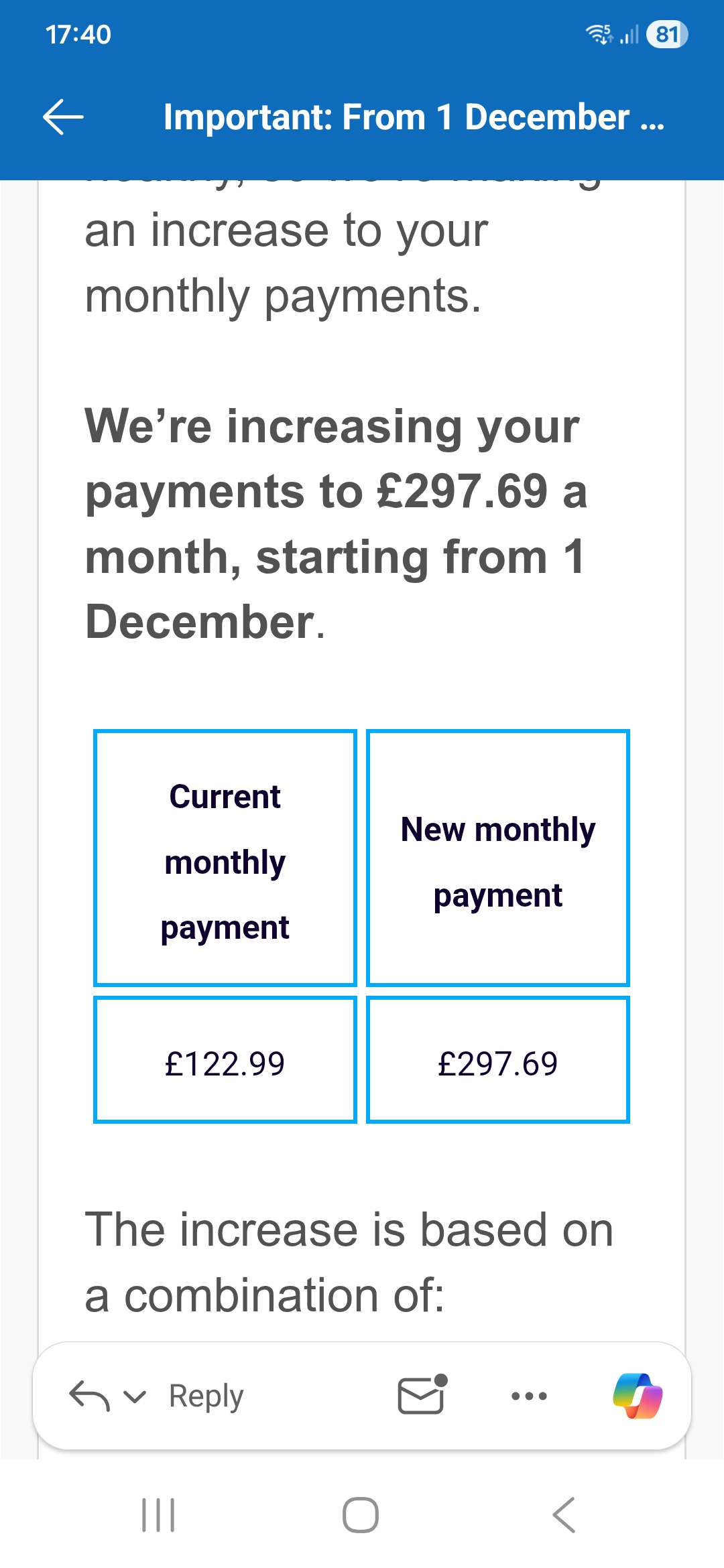

To anyone here who is on Octopus, give this website a go:

https://www.octopriceuk.app/compare

You simply put your account info in which links it to the website, it then tells you how much you would have paid on all of Octopus' different tariffs.

I for example paid £886 over the past year on Octopus agile for electricity (price changes every 30 mins) whereas it would have been £956 on Octopus tracker and £1057 on variable rate1 -

The report they are quoting from is very valid though. The figures direct from government accounts are correct.Huskaris said:Global justice now are just a protest group not a serious organisation, don't pay attention to them.

And I agree with net zero/renewables etc massively.

valleynick66 said:

My point is that even when you remove the VAT relief (which I agree is questionable though the OECD definition is one internationally used measure) the subsidies to fossil fuel still dwarf those for renewable energy. But because one is paid from general taxation and the other is put direct onto consumers bills, a choice made by successive governments, they are viewed differently. That is having a negative effect on the perception of renewables.

So to the original point are you pro or against this subsidy?cantersaddick said:

To be fair it's not saying all VAT is included just VAT relief. It is an OECD measure of subsidies so whilst maybe not perfect it is clearly a recognised and comparable metric.Off_it said:

That VAT "subsidy" figure is bollocks.ForestHillAddick said:

Yep sorry, I got a bit lost in the chain of comments.valleynick66 said:

Exactly. That’s my point.ForestHillAddick said:

I think important to note, the VAT 'subsidy' doesn't actually affect the fossil fuel companies, VAT is only paid by the end user, so the producers and whole sellers aren't ultimately liable for it.valleynick66 said:

And which is the direction of travel. ‘Green’ requires investment subsidies first.cantersaddick said:

I don't believe those make up that large a proportion of it. Either way none of it would be necessary with Net Zero. So still a massive saving on subsidies if we phase out fossil fuelsvalleynick66 said:

It’s a hugely complex market. But these notes on the article do add some perspective ie it’s not a simple cash giveaway :ME14addick said:

Thanks for posting, subsidising fossil fuels, when they make such huge profits is absolutely crazy.cantersaddick said:

The subsidies point is a rather frustrating misleading one though.ForestHillAddick said:Just to weigh in on this, the average UK energy bill is made up of 3 components:

1. Wholesale energy prices, for gas it's dependent on international markets mainly, for power is more dependent on gas price + domestic wind/solar production

2. Transportation and balancing costs, it takes money to maintain all the pilons and gas pipes without anything exploding

3. Subsidies, it also cost money to convince renewable developers to build their wind/solar sites in the UK, this money doesn't come from tax revenues, it gets added to end user bills instead

So just because wholesale prices drop, does not mean end user bills drop, in fact, by increasing renewable generation, you increase balancing and subsidy costs, so numbers 2 and 3 above will increase, whilst number 1 decreases.

The road to net 0 will not decrease bills in the next 20 years, it'll decrease bills after that in general, and hopefully environmental damage.

In my opinion, it's a price we have to pay now for future generations.

£2.4bn last year went on subsidies to renewables. Compare that to the £17.5 billion paid out in the same period in UK subsidies to fossil fuel companies (out of £7 trillion globally). These are huge multinationals making tens trillions in profit not innovating and not developing new technology or a public good. So no reason for these subsidies.It's is only by choice that the government puts the cost for one of these onto the consumers bills and the other is paid for out of general taxation. Imagine if the fossil fuel subsidies had always been paid for out of bills. Imagine the outrage. We would all be calling for renewables. But because that is indirectly paid and more murky no one seems up in arms.The research used the OECD definition of subsidies which encompasses:

- Tax relief schemes given to fossil fuel companies, including special ‘ring fence corporation tax’ rules that allow them to deduct capital investment (purchases of new assets and equipment) from the overall amount that is liable for corporation tax

- Financial support for the fossil fuel industry to invest in projects that allow for the continued production of fossil fuels – such as the government’s Carbon Capture, Usage and Storage Programme

- Measures taken by governments to artificially lower the price of coal, oil or natural gas, including the Reduced Rate of VAT for Domestic Fuel and Power.

The speed of change is a whole other story.Though why you don’t believe ‘they don’t make up a large proportion’ I’m not sure. The report sats(as I read it) £6.9b is down to VAT.

I believe the amount in that source is due to VAT only being 5% on domestic gas bills, were they to end that then VAT would become 20% on gas bills, all paid for by the end users.The headline of subsidies implies to the benefit of the multi national / large corporate whereas it’s the consumer benefiting.Dangerous headline statement.

Definitely in agreement on this.

Sure, a government could decide to whack up VAT on domestic fuel to 20%, but the fact they haven't hardly amounts to a subsidy. I mean, if we're going down that route you could also say the government "subsidises" the food industry, because most food is zero-rated. Or the book industry, for the same reason. Or maybe it subsidises private landlords because residential rents are exempt. As are funerals.

Someone will be claiming VAT's a "tariff" next.My point remains the headline and subsequent reaction we jump to based on the interpretation of ‘subsidy’ becomes a different story when you look at the scale of this element and who benefits from it.

If it was me I would end the subsidies to fossil fuel giants and pay the renewable subsidies from that saving therefore removing them from bills.

We still subsidies speculative drilling for oil and gas which causes massive wildlife damage and has low chances of success. And if there is success 100% of the benefit goes to the fossil fuel company and nothing to the government that paid the subsidy for it. The deal should have been drilling subsidies for a share of profits of what's found but we're about 50 too late for that. Time to get rid completely.2 -

So I can’t tell.cantersaddick said:

The report they are quoting from is very valid though. The figures direct from government accounts are correct.Huskaris said:Global justice now are just a protest group not a serious organisation, don't pay attention to them.

And I agree with net zero/renewables etc massively.

valleynick66 said:

My point is that even when you remove the VAT relief (which I agree is questionable though the OECD definition is one internationally used measure) the subsidies to fossil fuel still dwarf those for renewable energy. But because one is paid from general taxation and the other is put direct onto consumers bills, a choice made by successive governments, they are viewed differently. That is having a negative effect on the perception of renewables.

So to the original point are you pro or against this subsidy?cantersaddick said:

To be fair it's not saying all VAT is included just VAT relief. It is an OECD measure of subsidies so whilst maybe not perfect it is clearly a recognised and comparable metric.Off_it said:

That VAT "subsidy" figure is bollocks.ForestHillAddick said:

Yep sorry, I got a bit lost in the chain of comments.valleynick66 said:

Exactly. That’s my point.ForestHillAddick said:

I think important to note, the VAT 'subsidy' doesn't actually affect the fossil fuel companies, VAT is only paid by the end user, so the producers and whole sellers aren't ultimately liable for it.valleynick66 said:

And which is the direction of travel. ‘Green’ requires investment subsidies first.cantersaddick said:

I don't believe those make up that large a proportion of it. Either way none of it would be necessary with Net Zero. So still a massive saving on subsidies if we phase out fossil fuelsvalleynick66 said:

It’s a hugely complex market. But these notes on the article do add some perspective ie it’s not a simple cash giveaway :ME14addick said:

Thanks for posting, subsidising fossil fuels, when they make such huge profits is absolutely crazy.cantersaddick said:

The subsidies point is a rather frustrating misleading one though.ForestHillAddick said:Just to weigh in on this, the average UK energy bill is made up of 3 components:

1. Wholesale energy prices, for gas it's dependent on international markets mainly, for power is more dependent on gas price + domestic wind/solar production

2. Transportation and balancing costs, it takes money to maintain all the pilons and gas pipes without anything exploding

3. Subsidies, it also cost money to convince renewable developers to build their wind/solar sites in the UK, this money doesn't come from tax revenues, it gets added to end user bills instead

So just because wholesale prices drop, does not mean end user bills drop, in fact, by increasing renewable generation, you increase balancing and subsidy costs, so numbers 2 and 3 above will increase, whilst number 1 decreases.

The road to net 0 will not decrease bills in the next 20 years, it'll decrease bills after that in general, and hopefully environmental damage.

In my opinion, it's a price we have to pay now for future generations.

£2.4bn last year went on subsidies to renewables. Compare that to the £17.5 billion paid out in the same period in UK subsidies to fossil fuel companies (out of £7 trillion globally). These are huge multinationals making tens trillions in profit not innovating and not developing new technology or a public good. So no reason for these subsidies.It's is only by choice that the government puts the cost for one of these onto the consumers bills and the other is paid for out of general taxation. Imagine if the fossil fuel subsidies had always been paid for out of bills. Imagine the outrage. We would all be calling for renewables. But because that is indirectly paid and more murky no one seems up in arms.The research used the OECD definition of subsidies which encompasses:

- Tax relief schemes given to fossil fuel companies, including special ‘ring fence corporation tax’ rules that allow them to deduct capital investment (purchases of new assets and equipment) from the overall amount that is liable for corporation tax

- Financial support for the fossil fuel industry to invest in projects that allow for the continued production of fossil fuels – such as the government’s Carbon Capture, Usage and Storage Programme

- Measures taken by governments to artificially lower the price of coal, oil or natural gas, including the Reduced Rate of VAT for Domestic Fuel and Power.

The speed of change is a whole other story.Though why you don’t believe ‘they don’t make up a large proportion’ I’m not sure. The report sats(as I read it) £6.9b is down to VAT.

I believe the amount in that source is due to VAT only being 5% on domestic gas bills, were they to end that then VAT would become 20% on gas bills, all paid for by the end users.The headline of subsidies implies to the benefit of the multi national / large corporate whereas it’s the consumer benefiting.Dangerous headline statement.

Definitely in agreement on this.

Sure, a government could decide to whack up VAT on domestic fuel to 20%, but the fact they haven't hardly amounts to a subsidy. I mean, if we're going down that route you could also say the government "subsidises" the food industry, because most food is zero-rated. Or the book industry, for the same reason. Or maybe it subsidises private landlords because residential rents are exempt. As are funerals.

Someone will be claiming VAT's a "tariff" next.My point remains the headline and subsequent reaction we jump to based on the interpretation of ‘subsidy’ becomes a different story when you look at the scale of this element and who benefits from it.

If it was me I would end the subsidies to fossil fuel giants and pay the renewable subsidies from that saving therefore removing them from bills.

We still subsidies speculative drilling for oil and gas which causes massive wildlife damage and has low chances of success. And if there is success 100% of the benefit goes to the fossil fuel company and nothing to the government that paid the subsidy for it. The deal should have been drilling subsidies for a share of profits of what's found but we're about 50 too late for that. Time to get rid completely.Yes or no to the VAT subsidy of £6.9b of the total £17.5 b to fossil fuel companies?

it’s just you use the word ‘dwarf’.My point is the original headline was very misleading- I’m sure you agree0 -

£10.6bn still dwarfs £2 4bn. That's pretty comfortable. Or do you disagree?valleynick66 said:

So I can’t tell.cantersaddick said:

The report they are quoting from is very valid though. The figures direct from government accounts are correct.Huskaris said:Global justice now are just a protest group not a serious organisation, don't pay attention to them.

And I agree with net zero/renewables etc massively.

valleynick66 said:

My point is that even when you remove the VAT relief (which I agree is questionable though the OECD definition is one internationally used measure) the subsidies to fossil fuel still dwarf those for renewable energy. But because one is paid from general taxation and the other is put direct onto consumers bills, a choice made by successive governments, they are viewed differently. That is having a negative effect on the perception of renewables.

So to the original point are you pro or against this subsidy?cantersaddick said:

To be fair it's not saying all VAT is included just VAT relief. It is an OECD measure of subsidies so whilst maybe not perfect it is clearly a recognised and comparable metric.Off_it said:

That VAT "subsidy" figure is bollocks.ForestHillAddick said:

Yep sorry, I got a bit lost in the chain of comments.valleynick66 said:

Exactly. That’s my point.ForestHillAddick said:

I think important to note, the VAT 'subsidy' doesn't actually affect the fossil fuel companies, VAT is only paid by the end user, so the producers and whole sellers aren't ultimately liable for it.valleynick66 said:

And which is the direction of travel. ‘Green’ requires investment subsidies first.cantersaddick said:

I don't believe those make up that large a proportion of it. Either way none of it would be necessary with Net Zero. So still a massive saving on subsidies if we phase out fossil fuelsvalleynick66 said:

It’s a hugely complex market. But these notes on the article do add some perspective ie it’s not a simple cash giveaway :ME14addick said:

Thanks for posting, subsidising fossil fuels, when they make such huge profits is absolutely crazy.cantersaddick said:

The subsidies point is a rather frustrating misleading one though.ForestHillAddick said:Just to weigh in on this, the average UK energy bill is made up of 3 components:

1. Wholesale energy prices, for gas it's dependent on international markets mainly, for power is more dependent on gas price + domestic wind/solar production

2. Transportation and balancing costs, it takes money to maintain all the pilons and gas pipes without anything exploding

3. Subsidies, it also cost money to convince renewable developers to build their wind/solar sites in the UK, this money doesn't come from tax revenues, it gets added to end user bills instead

So just because wholesale prices drop, does not mean end user bills drop, in fact, by increasing renewable generation, you increase balancing and subsidy costs, so numbers 2 and 3 above will increase, whilst number 1 decreases.

The road to net 0 will not decrease bills in the next 20 years, it'll decrease bills after that in general, and hopefully environmental damage.

In my opinion, it's a price we have to pay now for future generations.

£2.4bn last year went on subsidies to renewables. Compare that to the £17.5 billion paid out in the same period in UK subsidies to fossil fuel companies (out of £7 trillion globally). These are huge multinationals making tens trillions in profit not innovating and not developing new technology or a public good. So no reason for these subsidies.It's is only by choice that the government puts the cost for one of these onto the consumers bills and the other is paid for out of general taxation. Imagine if the fossil fuel subsidies had always been paid for out of bills. Imagine the outrage. We would all be calling for renewables. But because that is indirectly paid and more murky no one seems up in arms.The research used the OECD definition of subsidies which encompasses:

- Tax relief schemes given to fossil fuel companies, including special ‘ring fence corporation tax’ rules that allow them to deduct capital investment (purchases of new assets and equipment) from the overall amount that is liable for corporation tax

- Financial support for the fossil fuel industry to invest in projects that allow for the continued production of fossil fuels – such as the government’s Carbon Capture, Usage and Storage Programme

- Measures taken by governments to artificially lower the price of coal, oil or natural gas, including the Reduced Rate of VAT for Domestic Fuel and Power.

The speed of change is a whole other story.Though why you don’t believe ‘they don’t make up a large proportion’ I’m not sure. The report sats(as I read it) £6.9b is down to VAT.

I believe the amount in that source is due to VAT only being 5% on domestic gas bills, were they to end that then VAT would become 20% on gas bills, all paid for by the end users.The headline of subsidies implies to the benefit of the multi national / large corporate whereas it’s the consumer benefiting.Dangerous headline statement.

Definitely in agreement on this.

Sure, a government could decide to whack up VAT on domestic fuel to 20%, but the fact they haven't hardly amounts to a subsidy. I mean, if we're going down that route you could also say the government "subsidises" the food industry, because most food is zero-rated. Or the book industry, for the same reason. Or maybe it subsidises private landlords because residential rents are exempt. As are funerals.

Someone will be claiming VAT's a "tariff" next.My point remains the headline and subsequent reaction we jump to based on the interpretation of ‘subsidy’ becomes a different story when you look at the scale of this element and who benefits from it.

If it was me I would end the subsidies to fossil fuel giants and pay the renewable subsidies from that saving therefore removing them from bills.

We still subsidies speculative drilling for oil and gas which causes massive wildlife damage and has low chances of success. And if there is success 100% of the benefit goes to the fossil fuel company and nothing to the government that paid the subsidy for it. The deal should have been drilling subsidies for a share of profits of what's found but we're about 50 too late for that. Time to get rid completely.Yes or no to the VAT subsidy of £6.9b of the total £17.5 b to fossil fuel companies?

it’s just you use the word ‘dwarf’.My point is the original headline was very misleading- I’m sure you agree

Not gonna get led down this road by you where you try to get a debate lost on semantics rather than actually engage with the point. Include it exclude it. Both definitions are valid and internationally recognised. I don't particularly care. Take your argument up with the OECD. Either way the subsidies to fossil fuel giants dwarf those to renewables which is a baffling state of affairs.0 -

You misunderstand me.cantersaddick said:

£10.6bn still dwarfs £2 4bn. That's pretty comfortable. Or do you disagree?valleynick66 said:

So I can’t tell.cantersaddick said:

The report they are quoting from is very valid though. The figures direct from government accounts are correct.Huskaris said:Global justice now are just a protest group not a serious organisation, don't pay attention to them.

And I agree with net zero/renewables etc massively.

valleynick66 said:

My point is that even when you remove the VAT relief (which I agree is questionable though the OECD definition is one internationally used measure) the subsidies to fossil fuel still dwarf those for renewable energy. But because one is paid from general taxation and the other is put direct onto consumers bills, a choice made by successive governments, they are viewed differently. That is having a negative effect on the perception of renewables.

So to the original point are you pro or against this subsidy?cantersaddick said:

To be fair it's not saying all VAT is included just VAT relief. It is an OECD measure of subsidies so whilst maybe not perfect it is clearly a recognised and comparable metric.Off_it said:

That VAT "subsidy" figure is bollocks.ForestHillAddick said:

Yep sorry, I got a bit lost in the chain of comments.valleynick66 said:

Exactly. That’s my point.ForestHillAddick said:

I think important to note, the VAT 'subsidy' doesn't actually affect the fossil fuel companies, VAT is only paid by the end user, so the producers and whole sellers aren't ultimately liable for it.valleynick66 said:

And which is the direction of travel. ‘Green’ requires investment subsidies first.cantersaddick said:

I don't believe those make up that large a proportion of it. Either way none of it would be necessary with Net Zero. So still a massive saving on subsidies if we phase out fossil fuelsvalleynick66 said:

It’s a hugely complex market. But these notes on the article do add some perspective ie it’s not a simple cash giveaway :ME14addick said:

Thanks for posting, subsidising fossil fuels, when they make such huge profits is absolutely crazy.cantersaddick said:

The subsidies point is a rather frustrating misleading one though.ForestHillAddick said:Just to weigh in on this, the average UK energy bill is made up of 3 components:

1. Wholesale energy prices, for gas it's dependent on international markets mainly, for power is more dependent on gas price + domestic wind/solar production

2. Transportation and balancing costs, it takes money to maintain all the pilons and gas pipes without anything exploding

3. Subsidies, it also cost money to convince renewable developers to build their wind/solar sites in the UK, this money doesn't come from tax revenues, it gets added to end user bills instead

So just because wholesale prices drop, does not mean end user bills drop, in fact, by increasing renewable generation, you increase balancing and subsidy costs, so numbers 2 and 3 above will increase, whilst number 1 decreases.

The road to net 0 will not decrease bills in the next 20 years, it'll decrease bills after that in general, and hopefully environmental damage.

In my opinion, it's a price we have to pay now for future generations.

£2.4bn last year went on subsidies to renewables. Compare that to the £17.5 billion paid out in the same period in UK subsidies to fossil fuel companies (out of £7 trillion globally). These are huge multinationals making tens trillions in profit not innovating and not developing new technology or a public good. So no reason for these subsidies.It's is only by choice that the government puts the cost for one of these onto the consumers bills and the other is paid for out of general taxation. Imagine if the fossil fuel subsidies had always been paid for out of bills. Imagine the outrage. We would all be calling for renewables. But because that is indirectly paid and more murky no one seems up in arms.The research used the OECD definition of subsidies which encompasses:

- Tax relief schemes given to fossil fuel companies, including special ‘ring fence corporation tax’ rules that allow them to deduct capital investment (purchases of new assets and equipment) from the overall amount that is liable for corporation tax

- Financial support for the fossil fuel industry to invest in projects that allow for the continued production of fossil fuels – such as the government’s Carbon Capture, Usage and Storage Programme

- Measures taken by governments to artificially lower the price of coal, oil or natural gas, including the Reduced Rate of VAT for Domestic Fuel and Power.

The speed of change is a whole other story.Though why you don’t believe ‘they don’t make up a large proportion’ I’m not sure. The report sats(as I read it) £6.9b is down to VAT.

I believe the amount in that source is due to VAT only being 5% on domestic gas bills, were they to end that then VAT would become 20% on gas bills, all paid for by the end users.The headline of subsidies implies to the benefit of the multi national / large corporate whereas it’s the consumer benefiting.Dangerous headline statement.

Definitely in agreement on this.

Sure, a government could decide to whack up VAT on domestic fuel to 20%, but the fact they haven't hardly amounts to a subsidy. I mean, if we're going down that route you could also say the government "subsidises" the food industry, because most food is zero-rated. Or the book industry, for the same reason. Or maybe it subsidises private landlords because residential rents are exempt. As are funerals.

Someone will be claiming VAT's a "tariff" next.My point remains the headline and subsequent reaction we jump to based on the interpretation of ‘subsidy’ becomes a different story when you look at the scale of this element and who benefits from it.

If it was me I would end the subsidies to fossil fuel giants and pay the renewable subsidies from that saving therefore removing them from bills.

We still subsidies speculative drilling for oil and gas which causes massive wildlife damage and has low chances of success. And if there is success 100% of the benefit goes to the fossil fuel company and nothing to the government that paid the subsidy for it. The deal should have been drilling subsidies for a share of profits of what's found but we're about 50 too late for that. Time to get rid completely.Yes or no to the VAT subsidy of £6.9b of the total £17.5 b to fossil fuel companies?

it’s just you use the word ‘dwarf’.My point is the original headline was very misleading- I’m sure you agree

Not gonna get led down this road by you where you try to get a debate lost on semantics rather than actually engage with the point. Include it exclude it. Both definitions are valid and internationally recognised. I don't particularly care. Take your argument up with the OECD. Either way the subsidies to fossil fuel giants dwarf those to renewables which is a baffling state of affairs.I’m not arguing the validity of the definition of a subsidy but the knee jerk reaction you and I are naturally inclined to from the headline.

You were quick to say no subsidies off the back of that but when the detail reveals a significant part is the VAT relief it’s less clear.You’d need also to understand the make up of the remaining sums to see if that is going to the bottom line of the fossil fuel companies.Fuel Duty was another big sum which I interpret as consumer benefiting for example.The devil is in the details.0 -

Sponsored links:

-

I would question the rest of those figures as well tbh:cantersaddick said:

£10.6bn still dwarfs £2 4bn. That's pretty comfortable. Or do you disagree?valleynick66 said:

So I can’t tell.cantersaddick said: