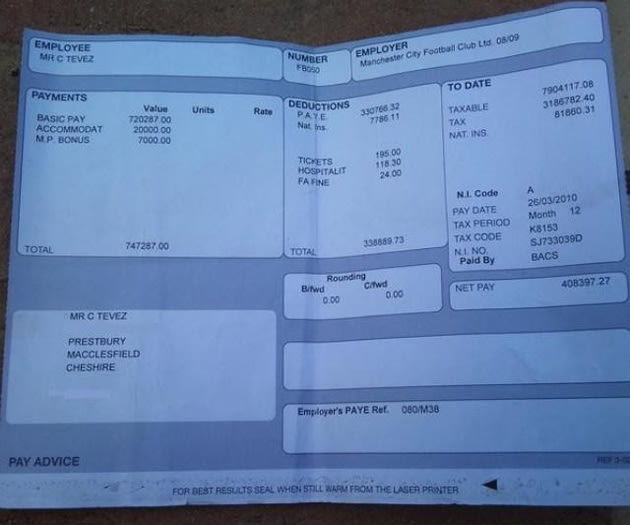

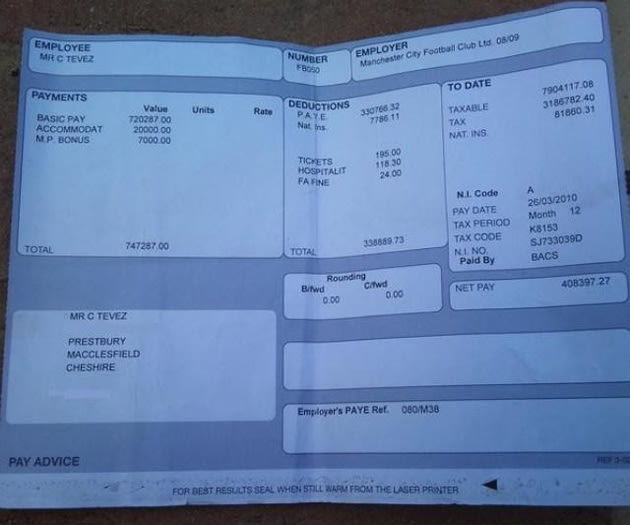

Tevez payslip

Comments

-

Notice FA fines are tax deductable0

-

Yes, but on the plus side he does get to keep £408,000 per month, I am sure he'll be able to keep the wolves from the door this month.Absurdistan said:Looks like the taxman loves the premier league. Must hurt to pay 340,000 to HMSC in 1 month (LOL)

This is three years old by the way, he's probably on a lot more now!0 -

Not sure why everyone is so shocked about this...we all already know how ridiculous players wagers are0

-

Absurdistan said:

Notice FA fines are tax deductable

£24 fine, is it worth it? They are fined the same as a Sunday morning player.

0 -

Tevez was at Man Utd for 08/09 season....he left that summer.0

-

Yes, he left for more money!Arry Addick said:Tevez was at Man Utd for 08/09 season....he left that summer.

0 -

Do not believe that this is real. Most of these footballers are 'limited companies'. In other words, their company gets paid gross and they get a dividend. This ensures that they ay a much smaller rate of tax. In other words, tevez would only pay approx 20% tax on that money.

No right minded individual on that size of salary would be PAYE and attract 40-51% tax.

There is also things like image rights and other bonus payments not showing.0 -

I see he was part of the Parliament expenses scandal getting an MP bonus0

-

The pay slip is from March 20100

-

Well at least he paid more tax than Starbucks and he probably makes a better cup of coffee!

He has gone up in my estimation for paying a fair whack of tax in relation to his income.

PS Cafc999 - it doesn't quite work like that - the dividends would be taxed as though they were earned income not dividends - the savings come in national insurance contributions.0 -

Sponsored links:

-

Macclesfield.0

-

But why would City be paying his wages for his time at United?Henry Irving said:The pay slip is from March 2010

0 -

0

-

Im confused now. He joined City in 2009, its dated March 2010 and Man City is on the payslip. Man Utd shouldnt come into it.colthe3rd said:

But why would City be paying his wages for his time at United?Henry Irving said:The pay slip is from March 2010

0 -

cheers for that sm, i don't know the full in's n outs of ltd company taxation but i know he would pay less.sm said:Well at least he paid more tax than Starbucks and he probably makes a better cup of coffee!

He has gone up in my estimation for paying a fair whack of tax in relation to his income.

PS Cafc999 - it doesn't quite work like that - the dividends would be taxed as though they were earned income not dividends - the savings come in national insurance contributions.

I have also found out that some of these lads do not get paid monthly. When beckham played for real madrid those players only got paid twice a year!! It was big bucks though0 -

it's fake anyway. You need to have your real name on the slip and Tevez isn't his real name.0

-

Believe it's real, mate of mine works for a football website and put it up, they got a letter from Tevez's lawyers (the amazingly named Teacher Stern solicitors) demanding they take it down as it was a confidential document.0

-

You're not the only one. Why would his payslip be from City dated March 2010 but have 08/09 (when he was at United) on it at the top?ValleyGary said:

Im confused now. He joined City in 2009, its dated March 2010 and Man City is on the payslip. Man Utd shouldnt come into it.colthe3rd said:

But why would City be paying his wages for his time at United?Henry Irving said:The pay slip is from March 2010

0 -

Name of the company? its probably fake anyway!colthe3rd said:

You're not the only one. Why would his payslip be from City dated March 2010 but have 08/09 (when he was at United) on it at the top?ValleyGary said:

Im confused now. He joined City in 2009, its dated March 2010 and Man City is on the payslip. Man Utd shouldnt come into it.colthe3rd said:

But why would City be paying his wages for his time at United?Henry Irving said:The pay slip is from March 2010

0 -

It is fake0

-

Sponsored links:

-

Sort of what I'm suggesting, but some here seem to believe it.ValleyGary said:

Name of the company? its probably fake anyway!colthe3rd said:

You're not the only one. Why would his payslip be from City dated March 2010 but have 08/09 (when he was at United) on it at the top?ValleyGary said:

Im confused now. He joined City in 2009, its dated March 2010 and Man City is on the payslip. Man Utd shouldnt come into it.colthe3rd said:

But why would City be paying his wages for his time at United?Henry Irving said:The pay slip is from March 2010

0 -

Was the Man City Ltd Company re....somethinged when they were taken over? Is that why it has a year on the end, like when we were re-whatevered in 1984? Man, my business terminology is terrible.0

-

fake0

-

Seems hard to beleive somebody earning that amount in this industry is on PAYE.0

-

This isn't exactly true. Footballer's are employees and therefore liable to tax earned on any income no different to anyone who works for a company that is registered in the UK. It is true that some footballers divert income, ie bonuses and sponsorships to Limited companies in the hope of paying corporate tax but this money, as someone has pointed out, is just as liable to the same levels of taxation if and when the individual takes a dividend.cafc999 said:

cheers for that sm, i don't know the full in's n outs of ltd company taxation but i know he would pay less.sm said:Well at least he paid more tax than Starbucks and he probably makes a better cup of coffee!

He has gone up in my estimation for paying a fair whack of tax in relation to his income.

PS Cafc999 - it doesn't quite work like that - the dividends would be taxed as though they were earned income not dividends - the savings come in national insurance contributions.

I have also found out that some of these lads do not get paid monthly. When beckham played for real madrid those players only got paid twice a year!! It was big bucks though

Tax is essentially based on your individual working situation as well as your domesticity. Where an F1 driver can work for a British based F1 team, he can choose to live in Monaco and pay no tax so long as he is not in the UK for more than 91 days a year. A footballer, playing for a British team, would find that very difficult to achieve.

0 -

Weren't City renamed 'Citeh 08/09 Ltd' or somesuch when they were taken over, like Jimmy said?0

-

So his first salary from Citeh would have been July 2009. His year to date figure is £7.9 - that's for 9 months.

With a gross monthly salary of approx £750k, he would have 'only' earned £6.7m. It doesn't compute.0 -

Signing on bonus? Other bonus before this pay slip?Addickted said:So his first salary from Citeh would have been July 2009. His year to date figure is £7.9 - that's for 9 months.

With a gross monthly salary of approx £750k, he would have 'only' earned £6.7m. It doesn't compute.0 -

EGAddick, you are kind of right. However, if you we're a footballer on say £10 million a year and you where PAYE you would be liable to 40-50% tax and a load of national insurance contributions. Now, change that to a ltd company and pay yourself minimum wage. You are now only paying minimal tax and NI and your company is only liable to corporation tax (which I think is about 20%). They would also 'employ' theire wives, family, etc,etc

Bare in mind these guys employ top accountants so they legally pay minimal tax by claiming business expenses.

I know a few people who run there own company that do this, yet they work for big companies non stop0 -

It's completely irrlevant if 'these guys employ top accountants' if you are a UK domicile and earn income here you are subject to UK tax. Footballers will be paid in separate ways, they will be an employee of a football club but they can earn sponsorships and things like 'image rights' as a director of a company - this, as you point out is taxed differently, but in the vast majority of cases footballers pay tax as employees and if they're earning the sums that are routinely quoted it'll be the top rate.0